Monthly Roundup

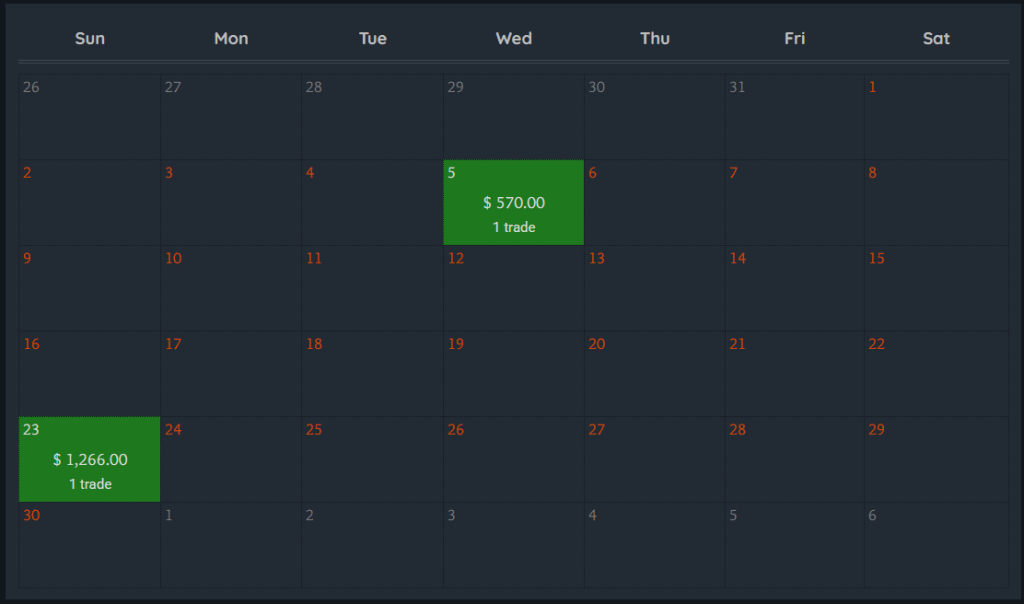

In November I made $1,836 in two trades.

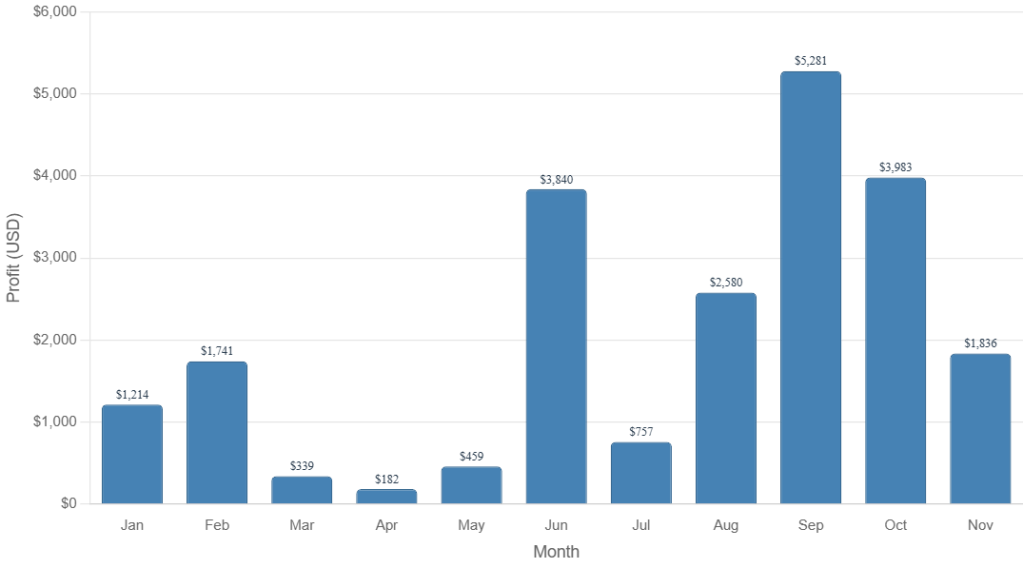

I’ve increased my accounts by $21,119 in the year of our Lord 2025.

Here are the trades lol.

Here’s a table of my monthly performance.

High Achievers, Peep This

I’ll be going over two strategies today, Cash Secured Puts and Covered Calls, there’s a quick primer here if you’re not familiar with them.

I mentioned last month that things are feeling a little unstable out there. I have pivoted back into selling options and attempting to trade more strategically as I sense the environment shifting. But, please keep in mind that I don’t know anything.

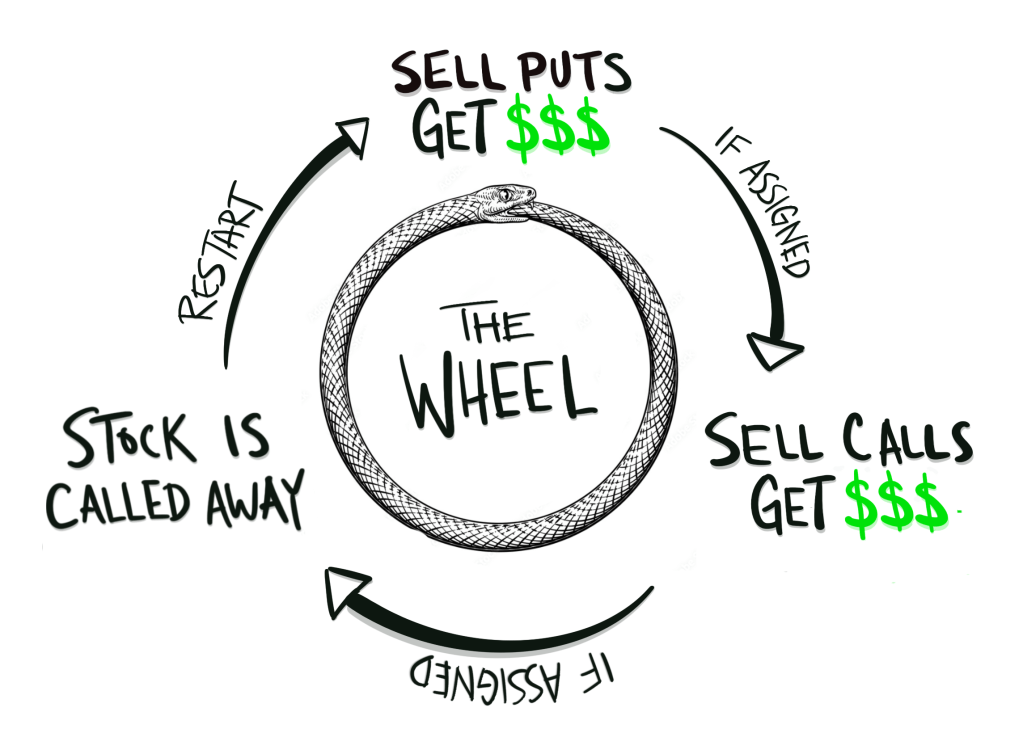

What I’d like to walk you through on this episode is The Wheel Strategy. It’s a combo of two strategies when you sell puts until you’re assigned shares, then you sell Covered Calls until they’re called away. Then you start over and repeat the process. The Wheel is about as safe as it comes in the world of options trading.

I’m going to discuss these strategies, walk you through a few scenarios so you can see why and how you would use them together, as well as some tips on how to glance at a chart to determine the best option to choose and when to execute a trade.

Here’s some brief definitions of some vocab that may be new to you.

Assignment happens when you, the option seller, are forced to complete the trade, either selling your shares or buying shares.

Strike Price is the specific price per share at which the underlying stock can be bought (for a call option) or sold (for a put option)

Premium is the immediate cash payment you receive from the option buyer for taking on the obligation of the contract, and it is the maximum profit you can make on that trade when you are the option seller.

Tryin’ to Make a Livin’ and Doin’ the Best I Can

Cash Secured Puts pay you a premium for agreeing to buy a stock if it is below a specified price by its expiration date. They allow you to generate income while giving you the opportunity to buy stock at a discount. They are a low-risk, high-probability trade.

Once I am assigned and own the shares, I wait for the price to recover. When the price rises back near the original price that I paid for the shares, I get paid to sell Covered Calls to sell the shares to someone else. These are also a low-risk, high-probability trade. They generate income while also hedging for a slight decline in a stock’s price.

By doing this, I’m essentially renting stocks and using them like a little business for making money by selling options around their price action, and am not as concerned about the stock’s price. Which will hopefully make more sense after I do some rambling.

In these two examples I’m about to show you, my only two trades this month, you can see how I was pretty off on the timing when selling the Cash Secured Puts, as the stock went way down afterwards. In both cases, on the day the contract expired, the stock just so happened to be at it’s lowest point. Ideally that is where I should’ve sold the puts. I perfectly timed the bottom in a hilariously dumb way.

But I can’t tell the future and this just shows that you don’t have to get the timing or direction right to be profitable with these strategies. This gives you a major advantage.

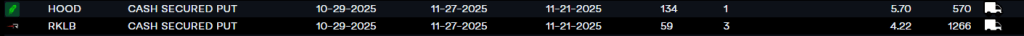

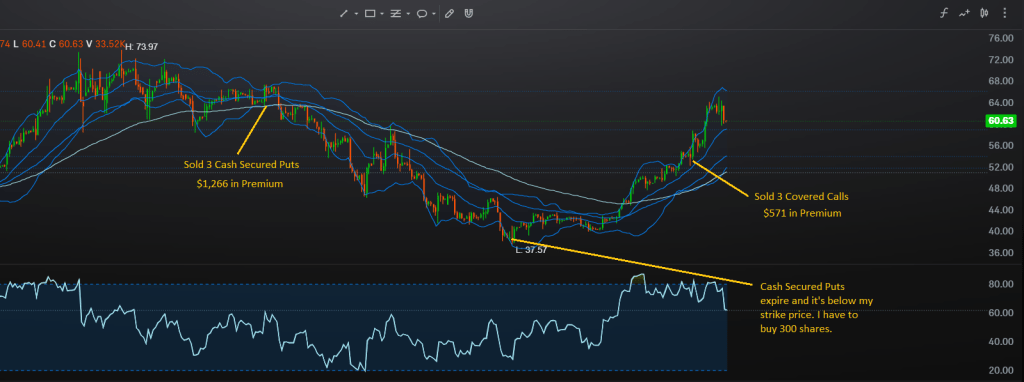

This first example is for Rocket Lab (RKLB). I sold 3 Cash Secured Puts at the $59 strike price that expired in one month while the stock was trading for around $65. This means that if the stock price is at $59 or below in one month, I am obligated to buy 100 shares at that price per contract, so 300 shares total for 3 contracts.

The reason I do this is because I wouldn’t mind owning the shares at that price and I get paid a pretty premium to sell the contract. $1,266 for 3 contracts in this case.

Again, when you look at it, I kinda did both of these trades at the worst possible time and I still made money. Therein lies the true beauty of selling options!

Now, you have to be able to stomach the downturn and have the patience to let the price rise back up before selling Covered Calls on the shares you now own. When you’re assigned on a Cash Secured Put, this ultimately means that something has happened and the stock price has dropped. More often than not, this means you have to buy shares for a price higher than they’re currently trading. This won’t feel great.

In the picture above, I agreed to buy those 300 shares for $59, so when the price dropped down to $37 that was a $6000 loss on paper, but not an actual loss, I just could have gotten them for cheaper if I were a little more psychic. All I did was wait for price to recover and now I’ve actually made $1,415 on the trade so far.

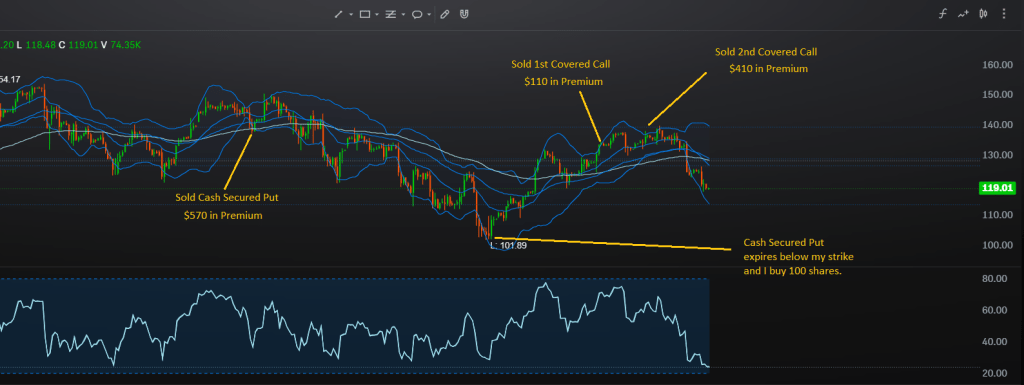

In the chart below, you’ll see I did the same thing with Robinhood (HOOD). While the stock was trading around $140-145, I sold a Cash Secured Put with a strike price of $134 that had a one month expiration. I was paid $570 to sell that contract. Afterwards the stock dropped way down and I was forced to buy 100 shares on the expiration date.

When I was assigned the HOOD shares I was forced to buy 100 at $134 while the stock was trading at $104. That’s a $3000 loss on paper from the start. I just had to be patient and let the price recover while doing nothing. Once it did in a week or so, I started selling Covered Calls against them to get rid of the shares. I’ve already made $520 in premium doing so.

In this way, I have bought a stock at $134 and sold it at $134, but have profited $1,090 so far. This is what I mean by using the stocks as more of a little business and making your money off of selling the volatility around the dramatic price action, if that makes any sense.

This takes a shift in your trading mindset and is something I’m still having to get used to. It feels unnatural. You’re not so much concerned about the stock price, but more concerned about how you can make money on their volatility and movement. You’ll ask yourself, “but what if the price goes up a little more”, and a thousand other hypothetical questions while trying to glean answers from your scrying mirror.

But you make money off the passage of time and wait for the bigger moves now. You’re not a boring buy-and-hold investor any more. You’re beyond space-time and hypothetical questions.

Not So Risky Business

I kinda just put a new heading there to help break up the whole thing and keep your attention. We’re still on the same subject. However, I do wanna switch it up and show you how you would go about selling options with the probabilities in your favor to suit your risk-adverse way of life.

When selling options, you can attempt to pick strike prices that you don’t think the stock will reach using probabilities that are clearly laid out for you in your trading platform.

For example, if you wanted to sell a Cash Secured Put on a stock but wanted the odds of getting assigned and having to buy the shares to be slim, you would look at the Delta of that option contract.

A contract with a .20 Delta means that there’s a 20% chance the stock will be at the strike price of your contract by expiration. So there’s an 80% chance that you won’t have to buy the shares and will simply get to keep the premium paid to you.

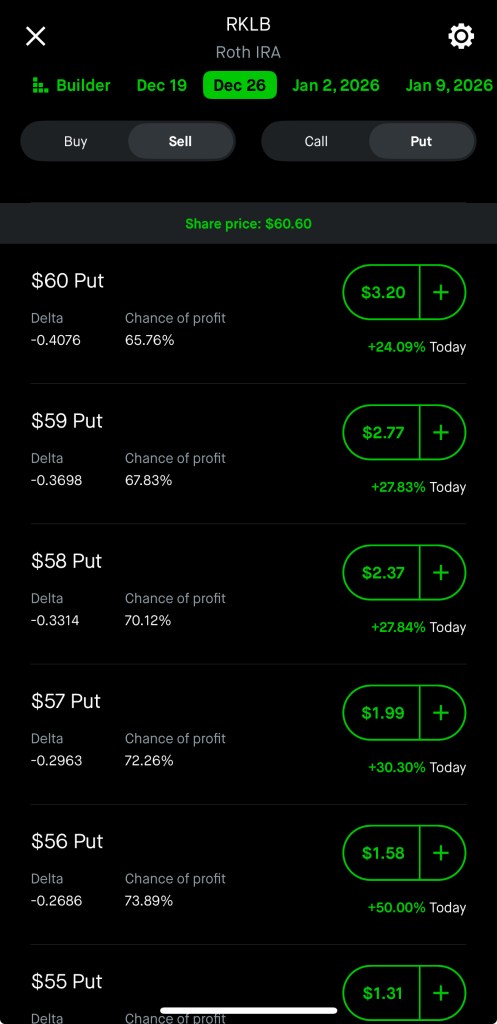

The higher the Delta of the contract the more premium is paid to you because the chances of it happening are greater. Here, let me show you what the option chain looks like on the Robinhood trading platform. This is where I get to pick and choose the contracts that I’m going to sell.

There are different dates to choose from at the top. Below that is a grey bar that shows the current stock price of $60.60. On the left are the different strike prices to choose from with the Delta listed beneath. The green numbers on the right show the premium I would receive for selling the contracts. That number is per share and each option contract is for 100 shares, so that $3.20 is $320.

So looking at that option chain, if I sold the $57 Put I would get paid $199 in premium. In two weeks, on Dec 26, if the stock price is above $57, I get to keep the $199. If the price is below $57 at expiration, I have to buy 100 shares at $57 regardless of what the current price is while also keeping the $199 premium. With a Delta of .29, there’s about a 30% chance of that happening.

This is where your personality and risk aversion come into play. I like to take larger, calculated risks, so I will often choose the contract right under the current stock price to get paid more. A strike price just below the current price is called “at the money” and you’re paid more for these because they are so close to the stock price, making the odds of you getting assigned pretty high.

Some people only sell Cash Secured Puts far below the stock price in an attempt to never get assigned, effectively using only their cash to make money without owning shares. This is cool.

However, you will notice as you retreat to the safety of the lower probability contracts that there is a trade off; you aren’t paid as much premium. With less risks, comes less rewards.

Keep in mind, we’re selling someone insurance when we sell a Cash Secured Put. You sold the put, so that means someone bought the put. The person on the other side of the trade owns the stock and bought the put option from you for the chance to sell to you should the price be below the strike price of the contract at expiration. I’ll understand if you need to read that again. This helps offset their losses on their investment and gives them an easy out should things go south.

Actually, I’m gonna go ahead and explain why the person on the other side of the trade is buying the Cash Secured Put your selling to help put it all in perspective.

For the sake of this example, let’s say our fictional trader, Travis, owns 100 shares and wants insurance on them in case the price drops significantly. He would buy a put contract against those shares.

Travis owns 100 shares at a price of $100. He buys a put option with a strike price of $90. This gives him the opportunity to sell someone the shares at $90 should the price drop to that. Even if the price drops to $10, he can still sell it at $90. The put contract that he bought as insurance will actually increase in value if the price drops and this is what helps to offset some of the losses. Just like real insurance, Travis hopes to not be put in a position to use it, though.

So Travis lost $1000 in value from the stock dropping from $100 to $90, but the the put contract he bought as insurance is now worth, let’s say $400, so his portfolio only drops $600 instead of $1000. It’s the definition of “hedging your bets” and is why a lot of people use options in the first place, especially for very large investments.

You, (insert name here), on the other hand, are brave and courageous and you wouldn’t mind owning the stock at $90 because you think that’s a great price! You assure yourself that if it were to drop to that, lots of other traders would agree with you and would start buying at the discounted price, too, causing the stock price to rise back up eventually.

You hope.

Using the power of indicators that I laid at your feet back in September’s post, you can spot the levels of support and resistance, and this can help you choose a strike price or plan your next move by seeing where price is likely to NOT go.

Below is a chart to show you what I mean. I’ve labeled the support and resistance levels as well as each time the price tested those levels and bounced off them with little sparkles. There are several ways in which to use this information when trading.

For example, there seems to be strong support at the $38 price, as once it broke through that price it has never dipped below it. So you could sell a Cash Secured Put with a strike price of $38 or lower and feel pretty confident in that.

Neat, huh?

And when it’s time for leavin’, I’ll hope you’ll understand

Alrighty, well I reckon that wraps up this month’s sermon.

Let us pray.

Lord, I pray that some of this technical jargon made sense to this congregation gathered here today. Bless my jokes so that they may all land in accordance to Your will. Forgive us our short-sided trades and lead us not into margin calls.

Forever and ever, until the closing bell. Amen.

Go in peace,

Chris

If you’d like to give trading on Robinhood a try you can click my referral link HERE and we’ll both get some free stock.

Further Education

Here’s a quick video explaining Cash Secured Puts. This guy is a straight-shooter and doesn’t put out flashy content.

This guy is a little more on the trading guru spectrum, but he does give really good advise and explains things clearly. This is a longer video but it will breakdown the whole process even more if you’re jonesing for it. Just don’t pay for a course or anything.

Leave a reply to Dad Cancel reply