Welp, things get a little worse this month as more tariff policies lead to instability in our everyday lives and that’s being reflected in the market. The market price measures the value that we place on everything and it’s a good indicator of the overall health of the economy. It contains two values; today’s value and the future’s potential value while simultaneously reflecting our needs, desires, and fears and from the looks of it there’s a lot of fear in the streets.

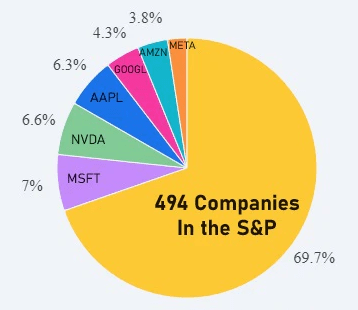

When you hear the market being talked about in the news what’s usually being referenced is the S&P 500 which is a weighted index of America’s top 500 publicly traded companies. The weighting system ensures that the largest and most valuable companies will carry the greatest weight in the index.

The top 10 companies in the S&P 500 carry 30% of the weight. To keep it short and sweet I’ll just say that I find these company’s stocks overpriced and overvalued and the whole thing doesn’t sit right with me. I recently sold all of my holdings of the index, a month later Warren Buffet made the same move, and now the market has dropped significantly in reaction to Trump’s trade war nonsense leaving me feeling like Dashboard Confessional’s 2004 smash hit from the Spider-Man 2 soundtrack.

Now whatever spices the good Lord has decided to flavor me with can lead me to find my interests a bit all-consuming and I’m known to hyper-fixate for stretches of time. I have to be mindful of this and remember to take breaks to keep the obsessions healthy and maintaining balance in my life. These pauses allow me to approach things again with fresh eyes and a new perspective and that’s how this recent slow down in trading has been for me. It’s been a nice, healthy pullback that has allowed me to focus on a lot of other, less dorky things while reminding me that there’s no need to rush when it comes to investing. Or anything else for that matter.

“The stock market is a device to transfer money from the impatient to the patient”

Warren Buffet

I feel like a lot of times we can view our weaknesses or flaws as things that needs to be fixed or completely eradicated. What many myths and spiritual teachings emphasize is that true growth and transformation come from facing and embracing our weaknesses, not just from exploiting our strengths. That our real strength can be found in our weaknesses.

On top of my downright addictive behavior another of my weaknesses has been patience, which I feel many can relate with. Through lessons learned from hobbies, mindfulness practices, and fatherhood I now experience the joys of delayed gratification and don’t find it as much of a struggle to hold my horses. Nature grows and moves slowly. When she moves swiftly it is usually destructive.

“Nature does not hurry, yet everything is accomplished”

Lao Tzu

Alright alright I’ll get on with it. Here are the numbers for March.

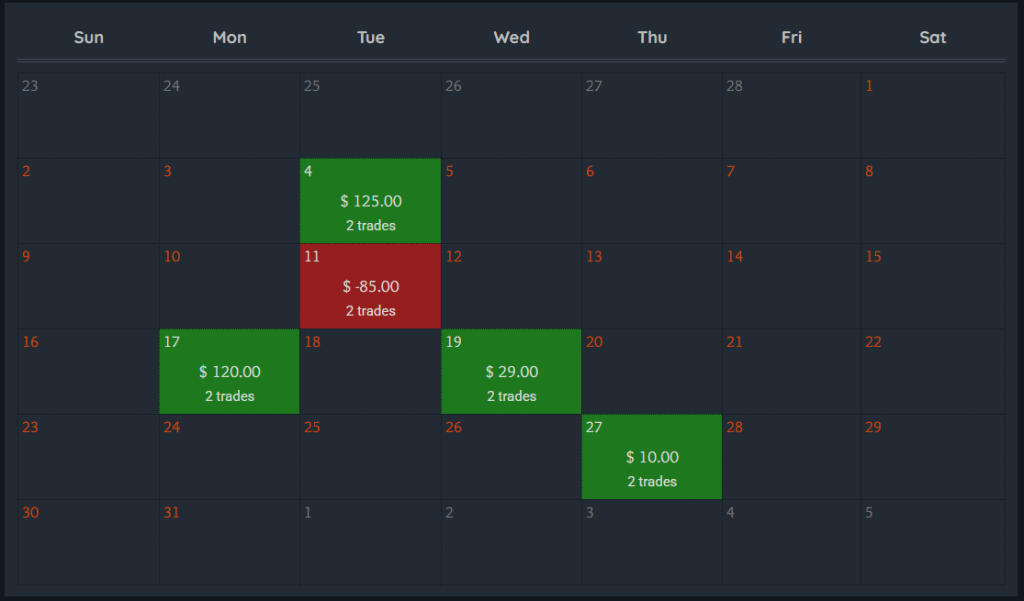

My monthly goal is to increase my accounts by 10%. In March I achieved an increase of 2.8% bringing in $339 total. womp.

I’m up 36% this year increasing my accounts by $3,294 so far in the year of our Lord 2025.

As an options seller I profit the most when volatility is high. While things right now are shaky, the market is efficient and every thing is already priced in. Meaning the tariffs were no surprise as it’s something that Trump campaigned on, so even though it’s tanking the market it doesn’t necessarily lead to higher volatility. The stocks that I’ve been writing Covered Calls on (SOFI, HOOD, SMST) have dropped so far below my cost basis that I spent a lot of time waiting on the sidelines for premiums to increase. In hindsight I would’ve done better settling for the lower premium than waiting for things to get better.

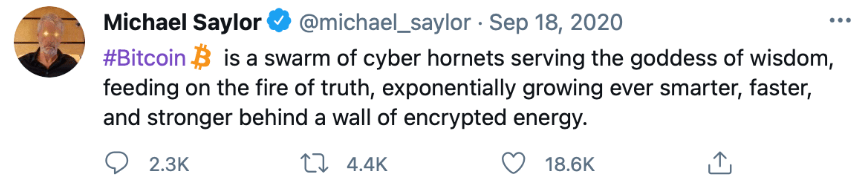

Let’s talk about my first losing trade since December 2024 and it’s a Bitcoin rant! MicroStrategy is a failing computer company that doesn’t make any thing new or make a profit for that matter and I’ve decided to take a bet against them. What they’ve chosen to do instead of investing back into the growth of their own company is to buy Bitcoin and have their value be based on something that’s value is based on sentiment.

For a time people who didn’t want to go through the hassle of setting up a crypto wallet would buy MicroStrategy stock using it as a work around for owning Bitcoin. But as the hype train rolled into the station and every one wanted in, the price of the stock was driven so high that if you bought in you’re actually buying Bitcoin at double it’s value. Not every one has realized this, yet.

But it appears I called their downfall a little early this month. I made a guess that people would wise up and the stock would plummet soon. I was wrong.

I sold a Cash Secured Put for 100 shares where I received $140 credit then used that to buy a Call for $85 that ended up expiring worthless. So all in all I’ve only lost $85 so far but it’s no skin off my back as I was playing with house money. But overall I’m currently down over $1000 on this contrarian position while I wait for things to recover. It’s not a loss if you never sell!!!

“I can calculate the movement of the stars, but not the madness of men.”

Sir Issac Newton

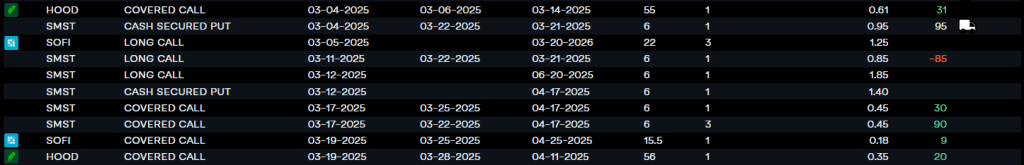

Newton actually said that after losing a fortune in the stock market and maybe we’ll talk about that later but I’ve kept you long enough so, finally, here are all my trades for the month.

Be patient.

Be kind.

Pay attention.

Thanks for stopping by!

Chris

Leave a comment