My goal on this page is to give you a brief explanation of the strategies you’ll mostly see me using on this site. If you are brand new to the stock market most people would suggest dipping your toe in with buying and holding ETFs for long periods of time. I started that way and I would agree with them.

What I will be discussing is the next natural progression – the trading of stock options. I have 3 or 4 strategies that I stick to and only focus on a handful of stocks at a time while maintaining a small watchlist. This keeps me focused and my trading simple and mostly passive. I don’t like being on my phone.

My bag of tricks

When I sell option contracts they provide me the obligation to buy or sell stocks in 100 unit increments at an agreed-upon price by a given date. Put in simpler terms, I’ll buy/sell this if it’s X price by X date.

Options give you leverage allowing you to control a lot more for a lot less. The trade off is they carry greater risks than the classic buy-and-hold method because option contracts expire making it crucial that you are correct by a certain date.

When it comes to selling options it’s easiest to think of it like car insurance. We pay a premium every month in the event that something bad happens while simultaneously praying that it doesn’t. Whether an accident occurs or not the insurance company gets paid a premium and the price of that premium is based on the risks involved. Higher risks = higher premiums.

You’re selling contracts then waiting for the value of those contracts to decrease so you can buy them back at a lower price.

Really trying to drive it home here. Buy Low, Sell High.

If the probability that the stock price will be at the strike price of your contract by the expiration date decreases, so does the value of your contract.

I sell Puts on red days and I sell Covered Calls on green days. You get paid a premium on day 1 of writing a new contract. The goal is to keep as much of that premium as possible. In most cases I close the trade when I reach 50% profit and never let the contract expire. So if I’m paid a $50 premium I only aim to keep $25 of that. This means I will buy back the same contract I sold to close it for $25 before it expires. This allows me to sell several contracts in the same amount of time, catching all of the fluctuations, and taking risks off the table sooner. Things do not go up or down in a straight line. The longer you’re in a trade the longer you’re risking something going against you that’s out of your control. Any time I’ve broken the 50% rule in the past I’ve regretted it.

Combining the first two strategies below together creates what is called “The Wheel Strategy”. You sell puts until you are assigned the shares. Then you sell calls until they get called away while collecting premium at every step. By reinvesting those premiums you lower your average cost down.

Now onto the strategies…

Selling Puts

When selling puts you profit when the stock price goes up.

I only sell puts on stocks that I wouldn’t mind owning. This opens a new contract that says, “OK, the current price is $10 a share. If the stock is $9 by the time the contract expires I agree to buy 100 shares at that price at $9 each. But for taking on that obligation you have to pay me a premium of $50 right up front.” This means the stock can go up and down and all over but as long as it’s above the $9 strike price by expiration I don’t have to buy it and I keep the $50 premium. You will then be required to set aside the collateral to own 100 shares of the stock in the account.

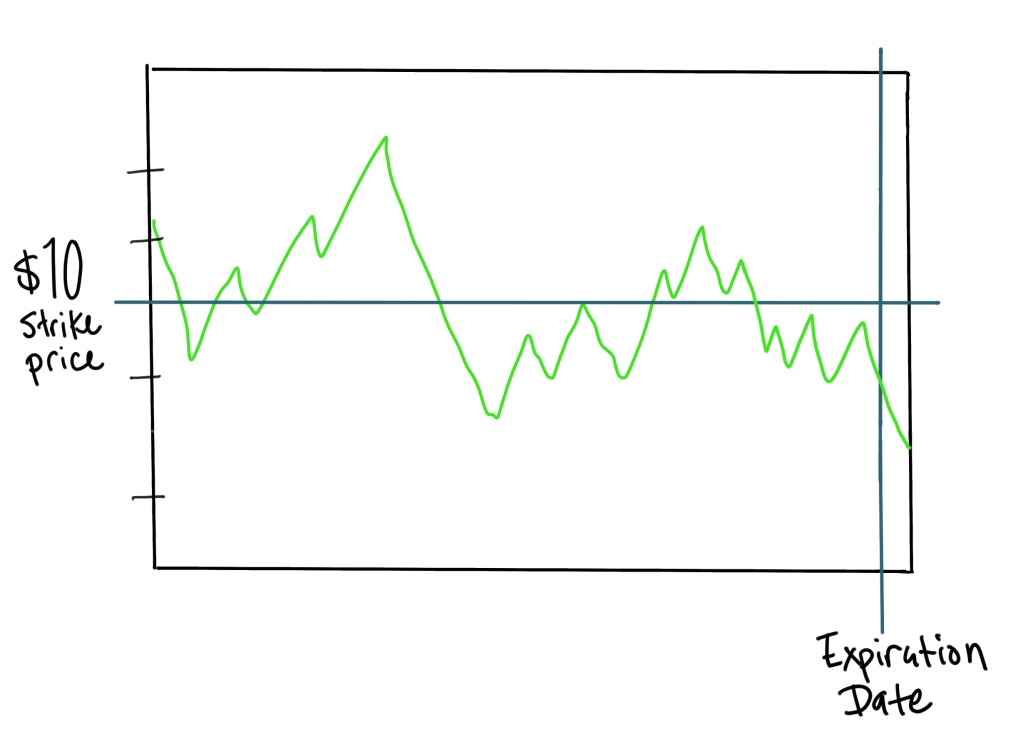

In the above example the stock price was above the strike price by expiration. This means I get to keep the $50 premium and my collateral is released back to me.

If the stock price is at or below $9 by expiration date you are assigned 100 shares. You must now hope that the dip in price is only temporary and not based on a big, scary event. If bad news comes out about the stock and it drops all the way to $4 you’re still under obligation to buy it at $9 or close the contract out for a large loss. So you must really want to own the stocks you’re dealing with while trying to use some technical analysis to help narrow down the best times to sell these contracts.

Below is an example from today. By watching a few indicators I was able to make a highly probable guess that the price was going to rise. I waited until the price rose above the 50 day moving average, pulled back to re-test that moving average, and finally I took on the trade once was there was confirmation that it was going to bounce off that moving average upward.

In an attempt to get the most premium paid to me I sell puts on days when the stock is doing very poorly, say, a drop around 5% or so. The premium on selling puts is higher when the price is going down because demand for those contracts increases. So in the same way that the car insurance company collects a higher premium for covering a teenager in a sports car, I collect the most premium for covering a stock when things are volatile and risky.

Usually the idea is to avoid getting assigned the shares and keep the premium or to purchase a stock you want to own at a price lower than the current market price. When you do finally get assigned 100 shares you can deploy the bizarro brother…

Covered Calls

Now that you’ve bought low its time to sell high! Covered Calls allow you to generate income on stocks you own while giving you downside protection if the stock drops in price. To continue with the above example we’re now saying, “Ok, I got these stocks I just purchased at $9. If they are $10 by the time the contract expires I agree to sell 100 of them at that price. But to take on that obligation you have to pay me an $80 premium.”

As pictured above, if the stock price is below the $10 strike price by expiration I get to keep my shares and the $80 premium. If the price of the stock is above the strike price at expiration then I sell 100 shares at $10 a piece while also keeping the $80 premium.

The biggest downside here is that some fantastic news comes out about the stock and it shoots up to $20 a share. You will still be obligated to sell 100 shares at $10 unless you choose to buy back the contract and close it at a loss in order to keep them. Ultimately with these strategies, though, there are defined risks going in so there are no surprises. Only pick prices you’re comfortable buying or selling shares at.

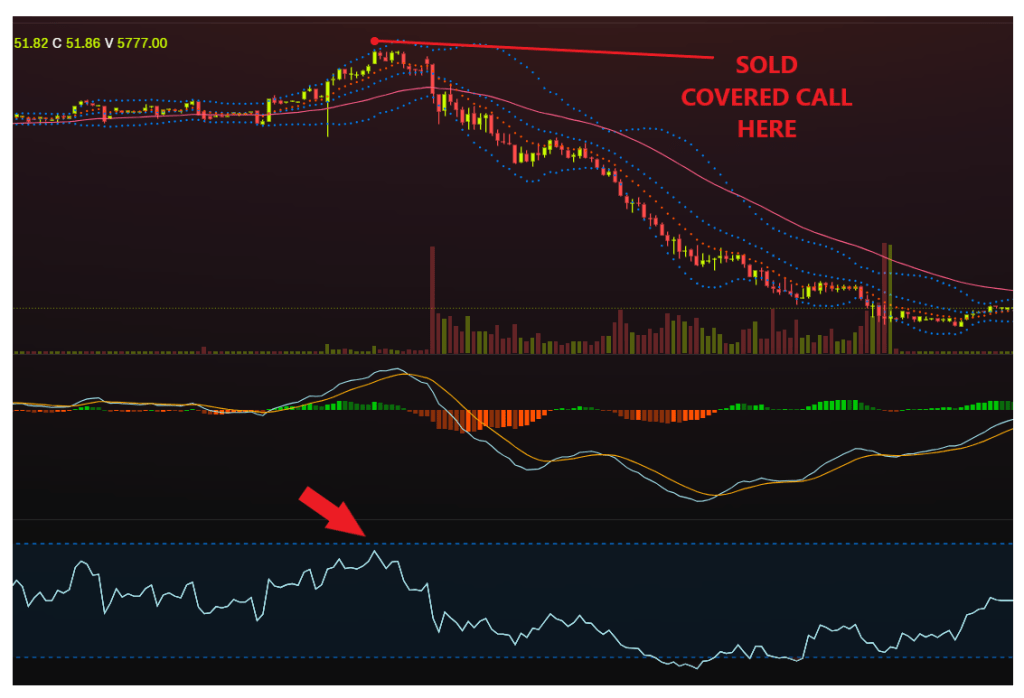

Below is a Covered Call that I sold today. By looking at volume and the RSI Indicator at the very bottom I could make an educated guess that the stock was currently overbought and due for a pull back in price soon. Covered Calls make money when there is a pull back in price so you profit even when the stock you own goes down. They’re hedging instruments, after all.

I sold the covered call at a high premium while the stock price was rising. I bought it back a few hours later at a lower price once the stock price went down. The option contract I sold was worth more when everyone thought the price was going to continue to go up. Now every one isn’t so sure so they’re not willing to pay as much making that option contract worth less. I profited on this change in sentiment by buying something back at a lower price than what I sold for.

Sometimes I skip selling puts and perform what’s called a Buy/Write. Meaning that on a day the stock is performing well I buy 100 shares then immediately sell a Covered Call against those shares. I honestly prefer this method as I personally feel better owning the shares in most cases, even if it’s only for a week or two.

Swing Trading

This is just buying shares of stock without the use of options and waiting for the price to go up. I will do this after a big drop in price on a solid company or when I believe a large swing upward is coming. This strategy is overall less risky because there is not a date that you need to be correct by. It requires more capital because it does not give you the leverage that options have. These trades are only meant to last a few days to a week.

And Last But Least –

Buying Calls

On occasion I will buy a Long Call or “LEAP” but honestly these are way more risky and they’ve burned me the most so I’m choosing not to go into detail about them here. They can be used as a stock replacement and they will pop up from time to time in my monthly reviews where I may attempt to justify my use of them. Buying options, as opposed to selling options, carries much more risk so you won’t see me doing much of it. When I do I make sure I purchase a contract with many months (sometimes years) until expiration so that I have plenty of time to be correct. When you buy options you have to spend money. When you sell options you are paid money. Guess which one I prefer.

Do what now?

I will be the first to tell you that I am NOT a fast learner. It took me many months to wrap my head around these things and I still have much to learn so don’t feel discouraged if it doesn’t make sense on the first readthrough. The vastness of information can almost feel overwhelming when starting something new, especially when you’re in a hurry to be good at it. Just ask my 13 other hobbies.

That’s all for now and I will get into what factors I look for when entering or exiting trades in future posts. Feel free to leave any questions or comments below.

If you’d like further info on any of these strategies check out Investopedia for a plethora of knowledge and less silliness.

Leave a reply to November 2025 – Moses of the South Cancel reply