Whattup?! Hope everyone is doing well. Let’s kick it.

All In

I’ve made around 150 trades so far this year and have only lost 4 of them. I think it’s time to crank it up and put my money where my mouth is.

So this month I started dumping every last cent I made into my brokerage account. I’ve even been donating plasma twice a week for a few years that pays an additional $500 a month, and all that goes in, too. It also doubles as a great time to read! Quick, easy, and painle…

What’s funny is the first half of the year I added almost no extra capital and solely traded with what was in there. Depositing nothing and withdrawing nothing. Now I put everything in, withdraw what I need, and I couldn’t be happier with the results. I even reached my monthly goal in the first week! (Spoiler alert: I reached my monthly goal on my first trading day in September)

In my experience money seems to work better when it’s transitional and being put to good use. It doesn’t like to be hoarded, static, and gathering dust. It likes to flow, it likes to be active and used honorably. This leads to less clinging and I don’t wind up being a dragon alone in my cave protecting a pile of gold that I have no need for.

There’s a parable where a master going on a journey entrusts his possessions to three servants. Two of them invest and double it, the third is too yellow-bellied and buries his. The master returns, praises the first two and punishes the third for letting his fear lead to his inaction. His money is taken away and given to one of the faithful servants.

We need to be accountable with our gifts, talents, and resources and use them for the benefit of others.

Live life with an open hand. Accept what is given and freely give.

Margin

If you have $2k in your brokerage account and meet certain criteria (or pretend that you do) you can trade on margin. Margin is just stock-talk for a loan. It allows you to purchase more than you could with your own cash, using your existing investments as collateral. If you have $5000 worth of stocks, for example, they will let you borrow an additional $2,500 at 5.75% interest, which ends up being around $0.40 per day. Not too shabby!

Let’s use a very modest example. If my portfolio was boring and growing at 8% per year and my margin loan costs 5.75%, I pocket the spread while still spending borrowed cash. This is called arbitrage and I’ll post a video down at the end if you want to see how someone uses this to have stocks pay for themselves over time.

Growing a small account can be pretty tricky and can take a long time if you’re playing things safely. Margin can give you a jump start by amplifying your profits and losses! You can even withdraw this margin to your bank account to spend how you please. In fact, borrowing against investments is exactly what the wealthy do! This avoids taxes because you don’t sell anything to get access to your money while also allowing you to stay invested.

(The margin rate drops to 5.5% in Sept)

Shifting Mindset

Until now my goal has been to simply grow the account, not live out of it. This is the first month that I’ve ever actually pulled money from it so this is a drastically different game plan for me. I’m switching from building up a stockpile to trading for income.

Last year I got out of debt the same week my truck died forcing me to buy another vehicle. I also happen to have a knack for buying something that will need a new transmission within the first week of purchase. So I went from debt-free, to buying a new car, then buying a new transmission for it in the same week.

All that to say, that $6000 transmission had to go on a credit card which has gotten a little out of control now that it’s had a year to snowball while I continue to use it. Surely someone can relate?

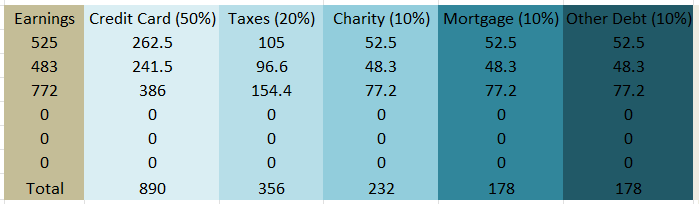

So my plan of attack is to take 100% of my profits from my brokerage account and heavily attack that bill along with some additional categories. I even made a spreadsheet that calculates everything for me when I punch in my profit!

You can see that as of starting this 3 weeks ago I’ve already been able to put almost $900 towards that credit card debt! And the way I see it I made that money by clicking a few buttons on my phone. Pretty rad if you want my honest opinion.

I have other categories that will move in once the debt gets paid down and I’ll increase the percentage of some of the pre-existing ones, but this debt gotta go.

This has been no small task. I’ve had to switch all my bills over, figure out how all this margin stuff works, and get used to seeing my bank account with $15.00 in it. Ok, well maybe I was used to seeing that already BUT I’M THE BANK NOW BABY!

Charity

This feels tricky to talk about so I’m just gonna try and speak as honestly as I can. My giving is coming from a genuine desire to help, not from a desire for recognition or praise. It’s also serving as an act of faith on my part. So don’t even talk to me about it.

On our first date Becky and I shared our biggest flaws with each other. I answered selfishness probably a little too hastily. (The anniversary of this date happens to be the same day I’m posting this.)

I can also tend to do quite a lot of living from a “scarcity mindset”, as they say, that can act the same as selfishness in it’s behavior. I can get overwhelmed with the sense that I need to gather and hold onto everything because I’m going to lose it all someday. I act as if I lack something.

Behind all the worry what I’m really saying is that I don’t have enough and I don’t have faith that the things I need will be provided for me in the future, though that has absolutely been the case up till this point.

The ugly truth is I’m rarely satisfied unless I take the time to recognize that my cup actually overfloweth all over the damn place.

I started donating to Give Directly in January and was just giving a small, fixed amount each month. Money was tighter then as we were just coming out of the holidays followed immediately by 3 big birthdays in my family. It was at this same time that I also stopped depositing money into the market.

I was punched in the soul at work one day with the realization that I’m just working frantically to fill my own barn with plans to build another so I could fill that one, too, and suddenly found my self crying in the corner of the greenhouse.

There have been several times where I’m casually looking at huge profits on my screen and still find myself wanting more. I’ll close out a huge win and instantly go on the hunt for another. Recently I’ve realized that a year ago I would have been in an ecstatic state of bliss over these wins. Now I’ve grown used to them and I want bigger numbers.

“Whoever loves money never has enough; whoever loves wealth is never satisfied with their income. This too is meaningless”. Ecclesiastes 5:10

So obviously I’m just chasing the green dragon here and needed to change my, “WHY”.

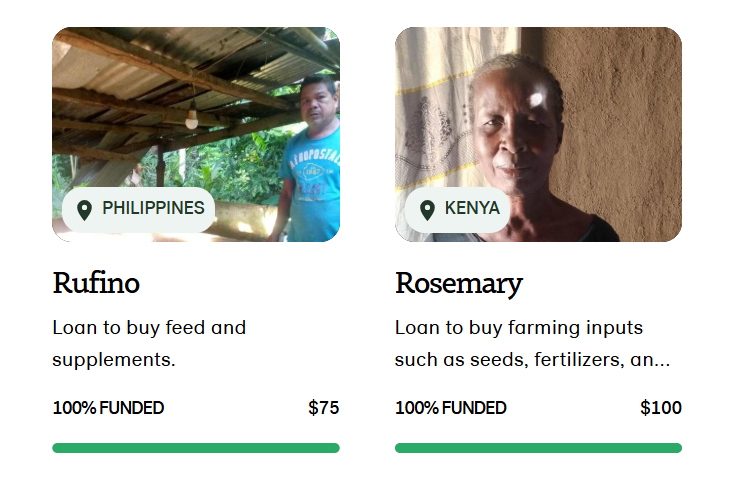

This has led me to discovering a unique way to give that has already brought me a lot of joy and feels more involved. Kiva is a microlender that connects you with people around the world allowing you to lend them money to help with a wide range of needs.

Let me introduce you to my first 2 friends.

Rufino is from the Philippines and is the caretaker of 5 young kids. He’s been in the pig raising business for 6 years and it’s how he provides for his wife and family. He was just asking for $75 for feed and supplements for them big boys and that just so happened to be what I was there to spend that day!

Rosemary is a widow and a farmer from Kenya. Their annual income is $1,800 and she’s having a tough time with her crops which she solely relies on to meet her family’s needs. So some bloke from England and I got her fully funded.

What I really like is that these loans are paid back so that the cash pool can really grow over time. The money is recycled so you’re able to lend a hand countless times.

I started teaching my son to invest at the beginning of the year and this month we started trading options in one of his accounts. He’s already made $345 in his first 3 trades. Crazy. But this poor dude is exactly like me so I’m trying to head him off at the pass and nip some of the shortcomings we share in the bud.

So I’ve decided to treat his account just like mine. Any money he makes goes into his account to invest, he pulls out what he needs, and gives to charity based off a percentage. I can only hope that instilling that not everything is intended for you early on will help him along his way.

Continuing with the honesty, giving is not easy for me and I think that’s the point. A sacrifice is not something that’s easy to hand over. When I made my spreadsheet I didn’t include the charity column at first and told myself that after the debt was paid down I would add it while still keeping my small monthly donations going. I even convinced myself with the oxygen mask analogy from airplane travel. Gotta take care of yourself before you can help others.

Ultimately I got punched again and decided against that. I cancelled my small monthly donation to GiveDirectly and started giving on a larger percentage of my earnings instead. Now the plan is when my debt is paid off I will up that percentage to a larger one.

I like the analogy of a rising tide lifts all boats over the airplane oxygen mask one.

Giving and receiving are the same thing. You gotta let some of it go to get the good stuff.

Through my whole stumbling journey I’ve learned that I’ve needed boundaries like this to keep myself from getting out of control. I tend to do all things to the extreme.

Roth & Roll!

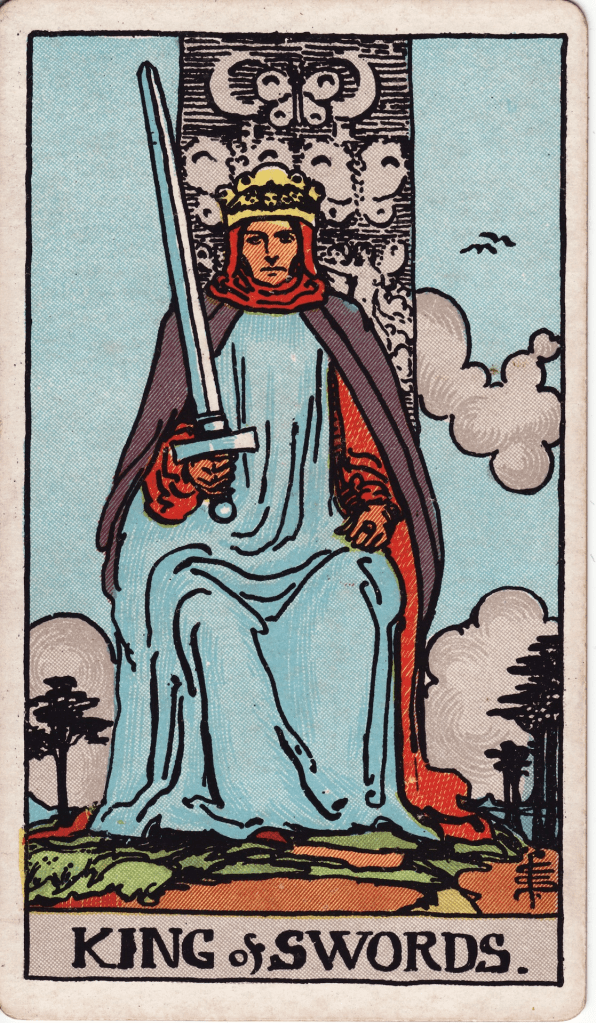

If we’ll remember, a Tarot card told me to get my shit together last month which led me to finding $12,300 in an old IRA from a previous job! Now let me tell ya, it’s been a doozy and a half to get this money moved over, and I’ll spare you all the details (except that they mailed the check to a very old address for starters), but when it’s all said and done it’ll be 2 months from the time I found it until I can get it moved over and start trading with it.

This thing only grew, like, 1.4% over the entire 10 year period. So it didn’t even beat inflation. I’ve heard horror stories of people not checking their retirement accounts until it’s too late. Most people don’t realize that their retirement accounts are investments in the stock market, they just think it’s some magical savings account. Even more so, sometimes you need to go in and specify how you want that money managed. I have no idea how mine was set up but the account only grew a hair over $100 in 10 years.

Go check your accounts, please.

Now I’m not a full-fledged King of Swords yet, but I’m on my throne and inching ever closer.

Knights of the WrapITUPALREADY!!!

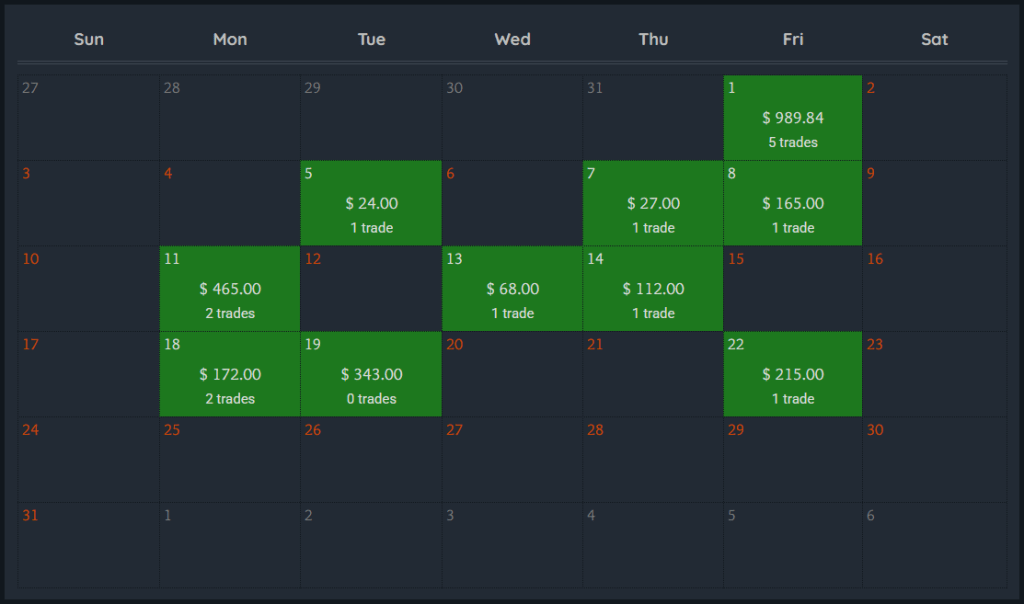

My monthly goal is to increase my accounts by 5-10%. In August I achieved an increase of 31.86% bringing in $2,581 total.

I’m up 110% this year increasing my accounts by $9,992 so far in the year of our Lord 2025. The S&P 500 has only returned 5.5% in this same timeframe.

If you’ll recall, last month I changed my monthly goal to accommodate a range instead of a fixed percentage. A goal of 5-10% vs the goal of 10% we had all grown to love. The decision to go all in with my whole paycheck was one of the main factors behind that. Also, now that the account is in flux constantly, a monthly percentage isn’t that helpful or accurate of a statistic.

To put some things in perspective, if you put your money into the S&P 500 you can expect to get an averaged return of somewhere between 7-8% a year.

Now I want to lay out 2 scenarios for you.

Scenario 1: I put $20,000 in the market, I drive to work, and 30 years later, with an 8% yearly return, I’m sitting on $201,000. Easy peasy.

Scenario 2: I put $20,000 in the market, but I’m a hot shot option trader with groovy, long hair and impeccable comedic timing. I get a return of 8% a month and in 30 years that’s $21.6 quadrillion. No goofin’ that’s the real math.

Now this may come as a huge surprise to you… but I am the hot shot trader from Scenario 2 and there’s no way that’s a feasible plan. Even with my perfect hair forever.

I’m not trying to fly too close to the Sun here. A little wing clipping does me some good sometimes before I get a little too ahead of myself.

Tldr: this gives me some breathing room, takes off a little pressure, and could prove hard to keep up with now that I’m dumping my whole paycheck in. Don’t be surprised if I stop listing monthly percentage all together.

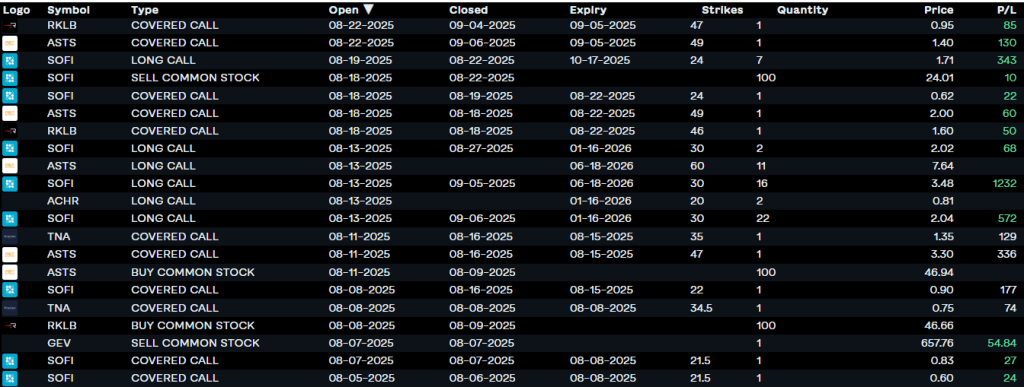

Here are the trades.

Here’s a table of my monthly performance compared to the S&P 500’s.

| Profit | % Change | S&P 500 | |

| Jan | $1214 | +13.7% | +2.7% |

| Feb | $1741 | +16.85% | -1.42% |

| March | $339 | +2.8% | +5.75% |

| April | $182 | +1.46% | -0.76% |

| May | $459 | +3.64% | +5.9% |

| June | $3840 | +38.6% | +5% |

| July | $757 | +4.5% | +2.2% |

| August | $2580 | +31.86 | +1.91 |

Oh Boy, There’s More?!?!

Welcome to the VIP LOUNGE.

Recently I’ve opened up even more by showing my whole account balance and making some videos as sometimes it’s just easier to show what I’m working with and talk it out.

In the first video both my kids went to the wrong school on their first day and I made $460 in the process of getting them to the right ones while selling in the money covered calls in standstill traffic.

Selling an “in the money” (ITM) covered call is a strategy that seems counterintuitive at first because it almost guarantees you will sell your stock. However, it is a deliberate move used for specific purposes, primarily to generate a large, immediate premium and to lock in money now. That’s a solid plan if I’ve ever heard one.

The longer I’m in the market the more I learn the value of a bird that’s already in your hand being worth more than the two birds that are slated to beat their quarterly projected growth with a 11% expected swing either way after earnings in the bush.

Here’s how this plays out. I know, I’m sorry for trying to explain a strategy at the end of such a long post, I’ll be brief.

In this strategy I’m buying stock then opening a contract to sell it at a lower price because I’m paid a lot of money to do that. This isn’t the way I, or most people, would usually trade covered calls. You normally offer to sell for a price above what you paid while mostly hoping that it doesn’t reach that price so you get to keep your shares and your premium.

Let’s say I see a stock that I believe is going up. I purchase 100 shares at $40 each. I sell a covered call that offers to sell the shares for $38 but I’m paid $350 for that option. If it continues to rise I lose $200 in the difference from my price paid vs price sold leaving me with $150 profit. Kinda funky, huh? I like it.

Here’s a video of me walking you through some trades where I execute this strategy. You might notice that I now flippantly trade a stock that I’ve anguished over in the past after the shares were called away. People can change.

In this video you get to see how some of my trades play out over the course of a whole week. You’ll see the good and the bad days along with even more thoughts from my head.

Alright, I’ll let you go.

If you’ve stumbled across my little ole site and you’re looking to get started, feel free to reach out and I’ll see if I can get you pointed in the right direction. There’s a plethora of info out there but I’ve noticed through teaching other interests of mine that people’s problems feel very authentic to them and it can be reassuring to have someone talk through a specific question or issue.

Thanks, as always, for stopping by!

Chris

You can be notified when I post by subscribing here on WordPress to receive an e-mail or you can follow me on Instagram which comes with some free jokes that I workshopped all month.

The video below is the one I discussed earlier in the Margin section, and he is actually the guy that got my gears turning on investing with my entire paycheck. He does things entirely differently as he buys dividend paying stocks with his paycheck, which then pay for themselves over time. If you are less risk-averse you might want to look into something like this.

If you’re interested you can research some ETFs like SPYI, QQQI, & XDTE.

Investopedia – Understanding Margin

If you’d like to give trading on Robinhood a try you can click my referral link HERE and we’ll both get some free stock. Or don’t use the referral I don’t care, just get started if you haven’t already.

Please remember that not a dedgum thing on this site is financial advice.