Boy Howdy!!

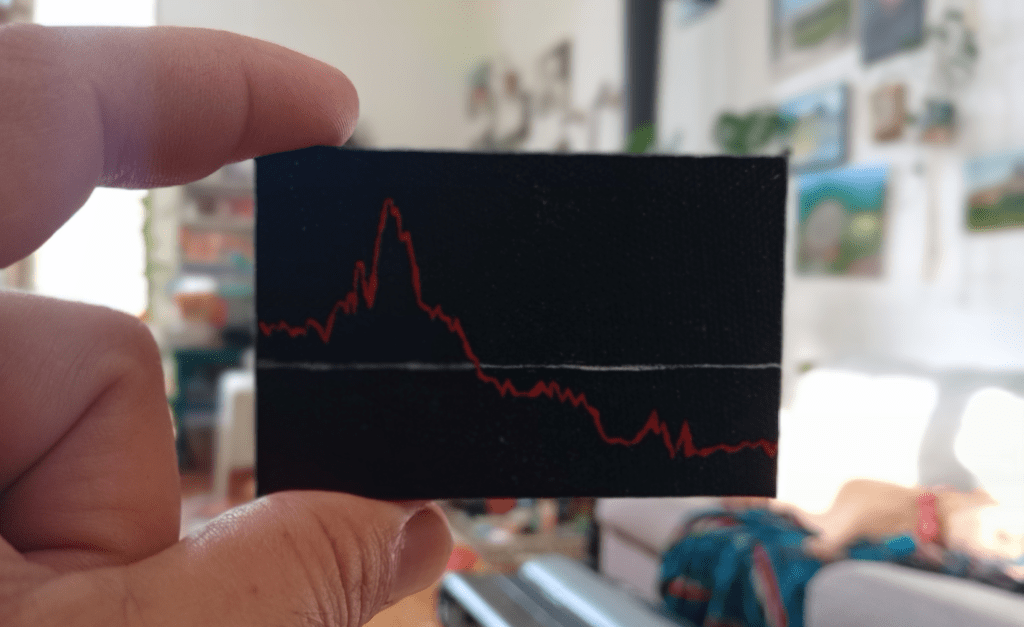

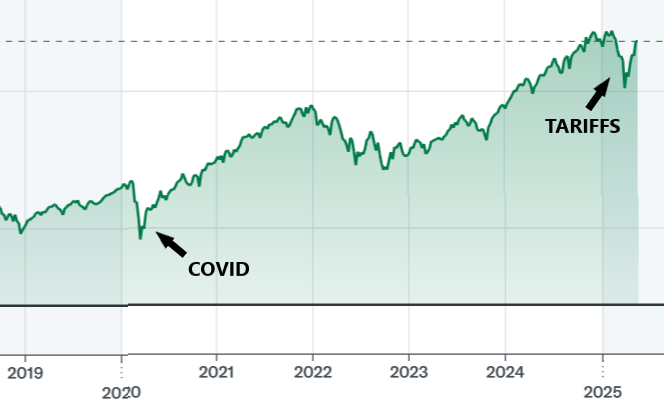

I’m not here to discuss the cons & cons of tariffs so here’s a quick run-down and comparison to show you just how much of an impact they are having on the market. I’ll keep it fun. Maybe even use a meme!

Stocks had been dropping in reaction to the trade war until a fake tweet went out saying tariffs were going to be paused sending markets soaring. That was until the White House later came out that day and said they would not be pausing tariffs. Then the following day the White House announces that actually they are pausing tariffs.

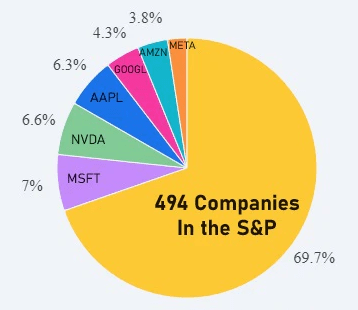

The market doesn’t have these huge fluctuations often, remember it’s made up of the top 500 companies so it has to be big news to move the needle … and tariffs be big. The S&P 500 lost approximately $2.4 trillion in value on April 3, marking its largest one-day loss since March 2020 (Covid). In total $10 trillion was wiped from the market in all of April 2025.

There were only 2 days in all of 2024 where the market had more than a 2% drop in a single day. So it was a wild ride to watch it sink 5% several days in a row. It was like watching a slow car crash but one of the cars has an open bag of my money inside of it with all the windows down. And while this has calmed down for the moment this is only a pause on tariffs and there doesn’t seem to be a real game plan on account of all the flippin’ and floppin’. (Note: I have listed examples of the aforementioned flippin’ and floppin’ at the bottom of the page for the sake of brevity)

Now, while I brought home some of my biggest losses this month others are having to postpone their retirement because their 401ks have plummeted. So you won’t find me complaining because I’m too busy out here counting my blessings.

“If we all threw our problems in a pile and saw everyone else’s, we’d grab ours back.”

― Regina Brett

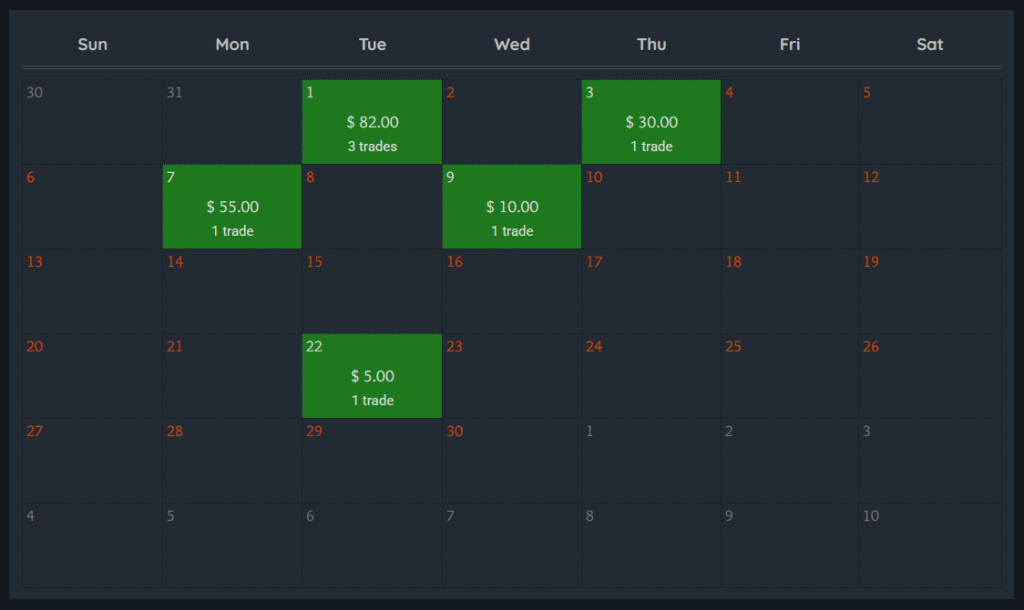

Speaking of problems let’s see how I did this month.

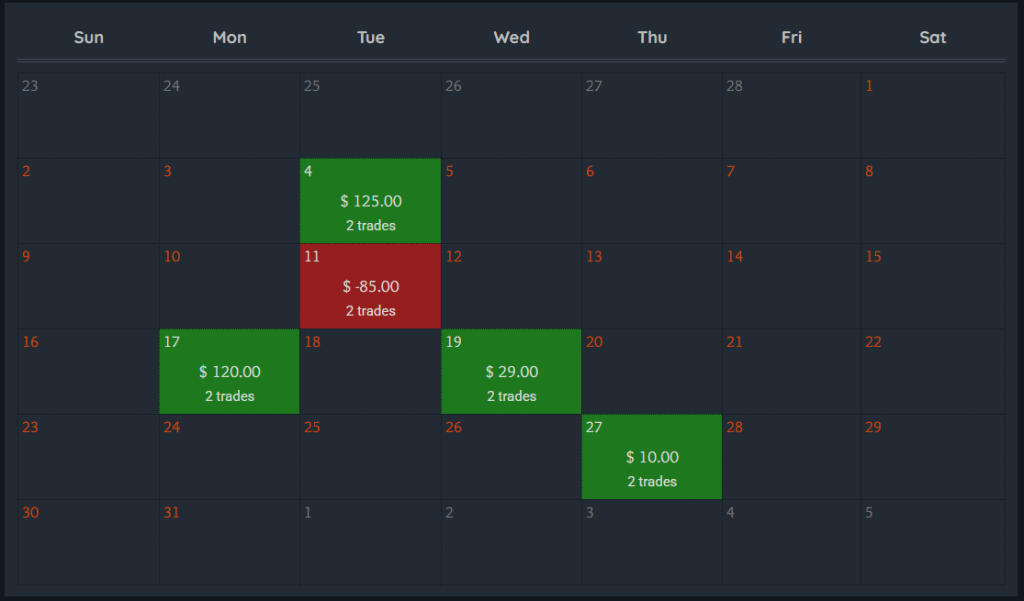

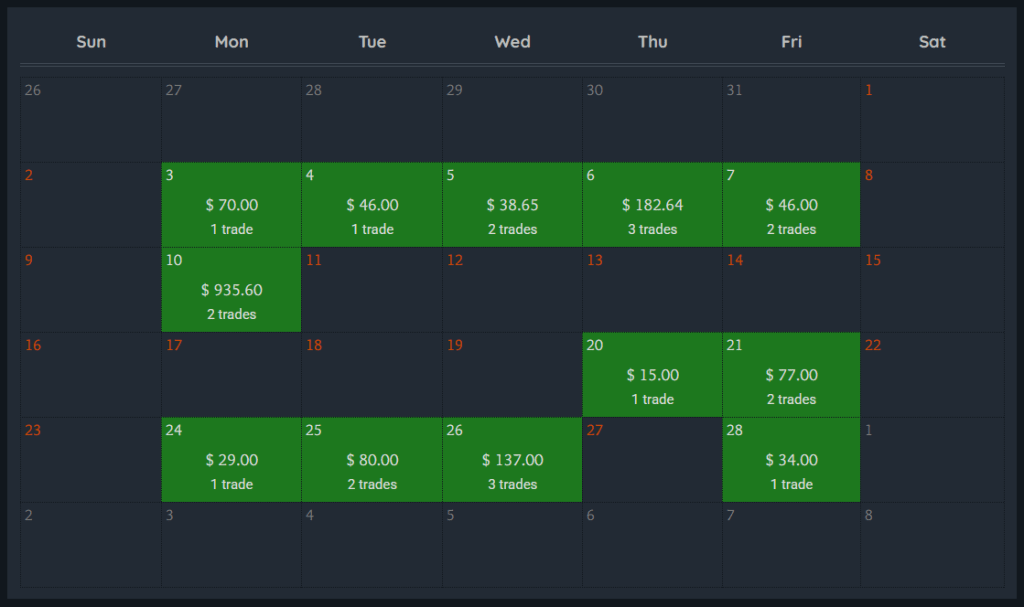

My monthly goal is to increase my accounts by 10%. In April I achieved an increase of 1.46% bringing in $182 total.

I’m up 38% this year increasing my accounts by $3,476 so far in the year of our Lord 2025.

On a side note, I found out while filing my taxes that you get credit for contributing to your 401k. I maxed out mine ($7,000 in 2024) and got $1000 back on my refund! I put most of that back in and made some trades with SMST. We’ll see how that’s playing out below where I give an update on my positions.

Here’s a table of my monthly performance compared to the S&P 500’s.

| Profit | % Change | S&P 500 | |

| Jan | $1,214 | +13.7% | +2.7% |

| Feb | $1,741 | +16.85% | -1.42% |

| March | $339 | +2.8% | +5.75% |

| April | $182 | +1.46% | -0.76% |

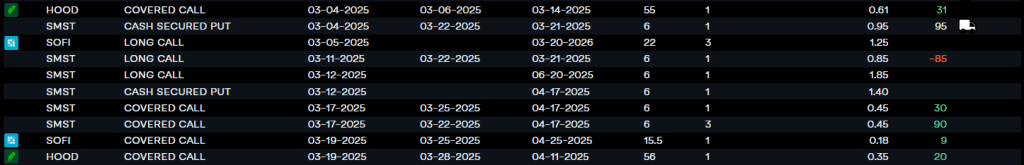

And here’s a sad update on my positions.

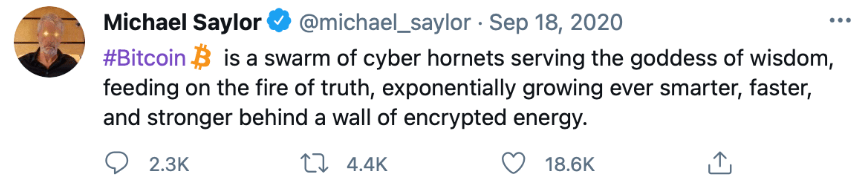

SMST – This was my anti-MicroStrategy/Bitcoin play I carried on about last month. I believe this company is doomed to fail. This stock is Inverse and 2x Leveraged so it does the opposite of what MicroStrategy (MSTR) does at double the speed. These “opposite day” ETFs are handy when the stock it follows is very expensive, as is the case with MicroStrategy which is currently trading around $400. In my case I’m using it in lieu of buying Put options in hopes to profit off of a declining stock price.

I own 600 shares that started with a cost basis of $6 per share but I’ve lowered that to $5.17 with the use of options. It’s currently trading around $1.30. Total return as of writing this is -$1,780. ouch.

The share price is so far below my cost basis that it’s near impossible to even sell a Covered Call against the shares.

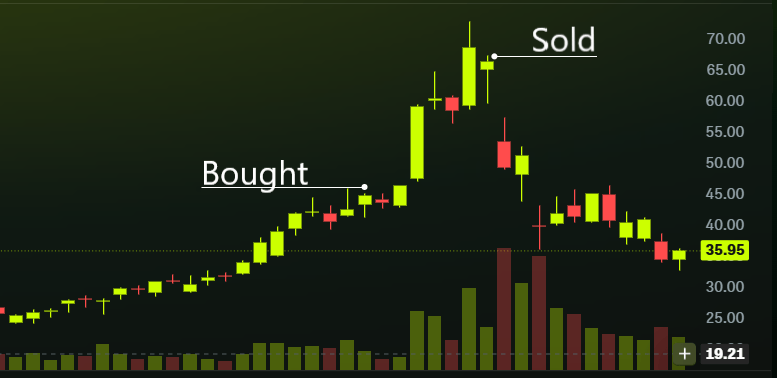

HOOD – Last month this stock was in the same boat as SMST is now. I was down almost $2k on it and was just having to wait for the price to recover while selling Covered Calls against my shares with very little premium. Well, it finally bounced back and now I’m up over $600 on it. I own 100 shares that I bought at $56.17 each and have made $303 selling covered calls, bringing my share cost down to $53.

Spoiler alert – These shares finally get called away next month thanks to one of the Covered Calls I sold, freeing up $5,500.

SOFI – Been selling Covered Calls against my 100 shares for very little premium. In doing so I’ve brought my cost down from $15.41 to $14.86. Really hoping to get these called away soon, the premium has not been worth it.

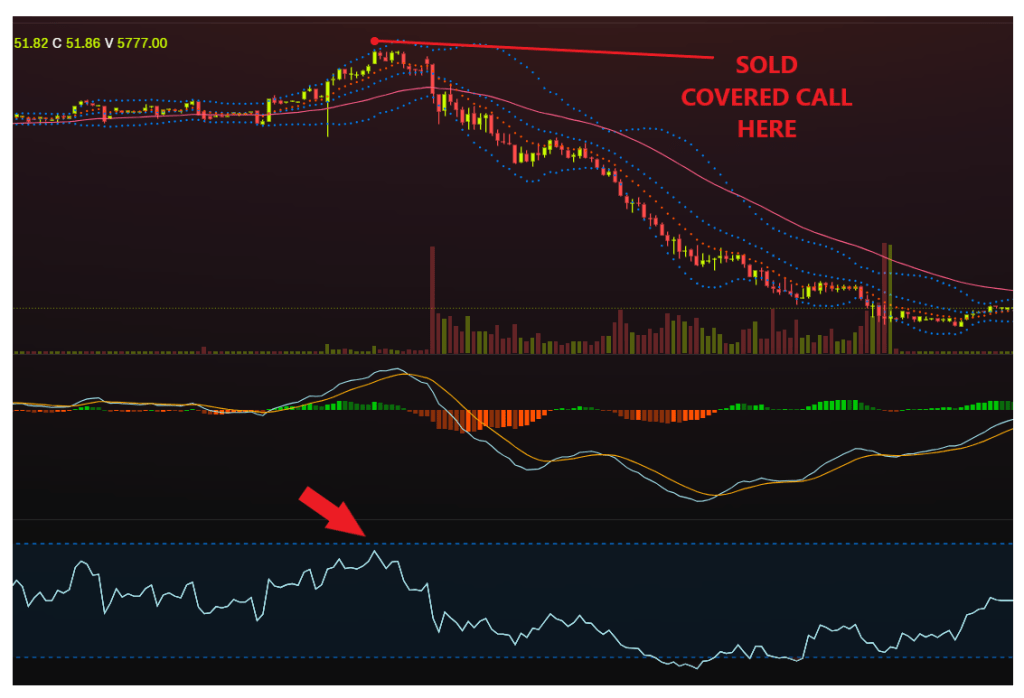

NVIDIA – Before all this tariff nonsense went down Nvidia was experiencing a drop in price thanks to some news about DeepSeek in China. They were able to develop an AI model without the use of Nvidia’s latest and greatest chip causing the stock to nosedive. Nvidia designs chips but relies heavily on the global supply chain and their manufacturing is outsourced mostly to Taiwan. So when they started in with all the tariffs that price dipped a lot more.

I bought 11 shares at ~$125 each but since the market conditions have changed I was quick to sell them for a small profit when the opportunity finally presented itself after a few months of waiting. I only made $55 off the trade but I got $1,400 back off the table. The risk vs reward was not worth it and now I can make better use of that capital elsewhere. Especially combined with the profits from Robinhood mentioned above.

The Misery Hymns Of Mammon

I told ya’ll buying Calls was risky on my Options Explained Gently page and you’re about to see why. These were bought back in October and December with plenty of time till expiration, so I was at least playing it on the safer side. Safe as a snail in a sandstorm, look at these losses!

Denison Mines (DNN) – $210

I bought 22 Calls with an average price of $10 over the course of a few months. This was a 205 day trade. DNN was a play on the possibility of the Uranium sector growing because of it’s use in nuclear energy. They reported significant losses at the end of last year and this recent change in global market dynamics was the nail in the coffin. Lessons learned? Stop messing with penny stocks.

Hanesbrand (HBI) – $780

I bought 8 Calls with an average price of $130 over the course of a few months. This was a 163 day trade. Hanes, I wish I knew how to quit you. This was one of my first stocks to trade because of it’s cheaper price and it seemed to be undervalued while, at the same time, aggressively paying off it’s debt.

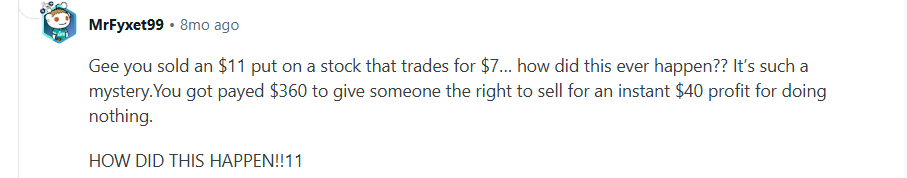

Back when I really didn’t know what I was doing I had sold a Put Credit Spread with the strike price wayyyy above the current stock price. Simply put, I had unknowingly offered to buy something at a much higher price than what it was currently being sold at. I was assigned 100 shares late at night while in the middle of a hurricane with the power out because of this dumb thing I did from a lack of understanding. I’m still getting teased for nervously waking my girlfriend up so I could use her hotspot to figure out what just happened and how badly I goofed. I was also mocked online when asking for clarification which I deserve and humbly accept.

Thanks, Mr. Fyxet!

Long story short, every thing was fine and I did profit but it showed me that I really needed to slow down and learn the mechanics behind it all before diving in head first. Unsurprisingly, this is not new behavior for me. I’m prone to want to skip ahead and get to the fun stuff.

How you do anything is how you do everything.

For example, I’ve been playing drums and guitar for about 25 years but I’m still having to go back and learn some rudiments or music theory that I rushed over when I started out. I want to advance quickly and that rarely works for me as I find myself having to backtrack or not being able to go up a level because I never even put in the ground floor.

In my defense I bought these Calls before drastically changing my game plan and strategy last year. The consequences just caught up to me this month. Karma takes it sweet time.

If I could turn back time (Final thought’s I’d like to Cher)

Cash is a position. I need to have money ready for when an opportunity presents itself. I thought I could quickly grow the extra cash I had sitting there but all I’ve done is miss out on a lot of opportunities over these last few months because my capital was tied up elsewhere. There’s money to be made when there’s blood in the streets.

In regards to SMST, I probably shouldn’t speculate like that. This is where most of my capital is tied up currently. The markets are unpredictable and they will surprise you. We got up at 4am once to watch a satellite launch I was invested in. Everything went smoothly and it was a huge success and then I watched the stock immediately drop 15%.

Bad times serve as points of refinement. We’re going to make mistakes and things will be out of our control, that’s inevitable. The quicker you can realize, admit, then learn, the more fun you’ll have.

Yabba dabba doo,

Chris

If you’d like to give trading on Robinhood a try you can click my referral link HERE and we’ll both get some free stock.

PS – Here are the flip flops from earlier.

March 2025: Trump announced a 25% tariff on auto imports from Mexico and Canada, only to postpone them days later amid concerns over supply chain disruptions. Source

April 2025: A sweeping 10% global tariff was introduced, followed by a 90-day pause just hours after implementation to allow for trade negotiations. Source

April 2025: Tariffs on Chinese goods were raised to 145%, then reduced to 30% as part of a temporary truce.

April 2025: An initial plan to impose cumulative tariffs on imported vehicles and steel was modified to exempt automakers from overlapping tariffs. Source

February 2025: Trump proposed “reciprocal” tariffs to match other countries’ rates, a significant shift from previous trade policies. Source