Monthly Roundup

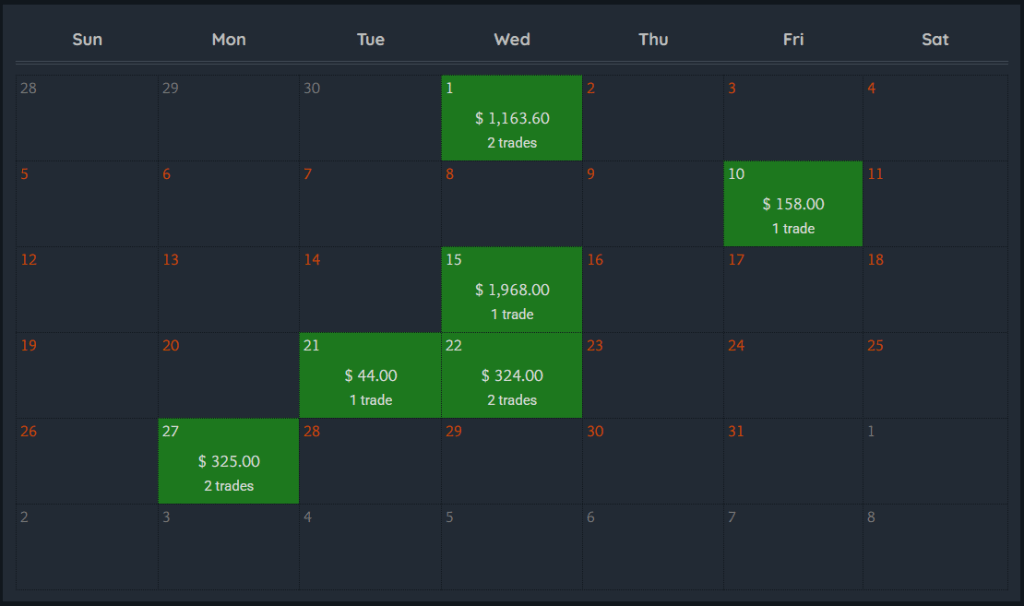

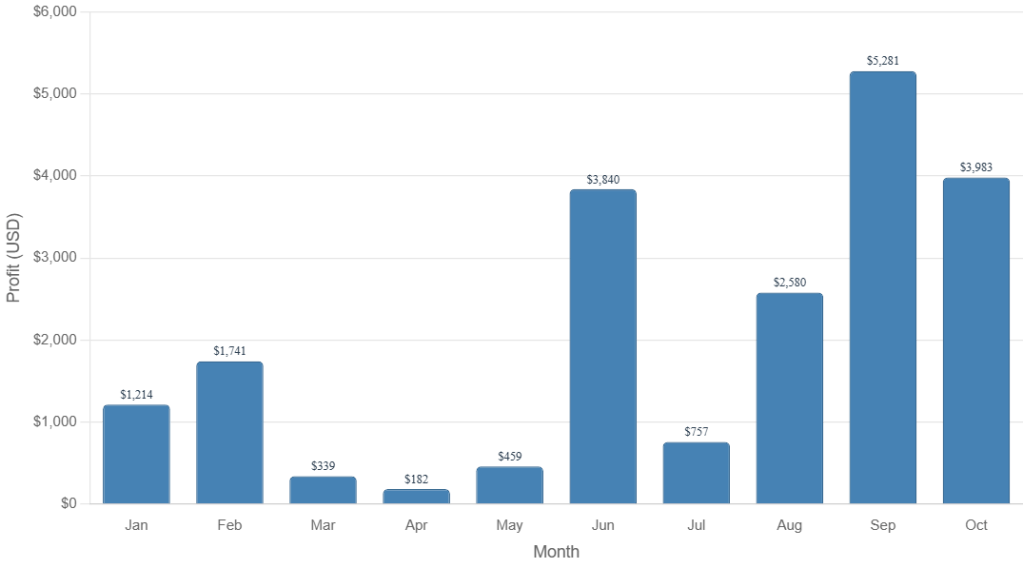

In October I made $3,983 in total.

I’ve increased my accounts by $19,284 in the year of our Lord 2025.

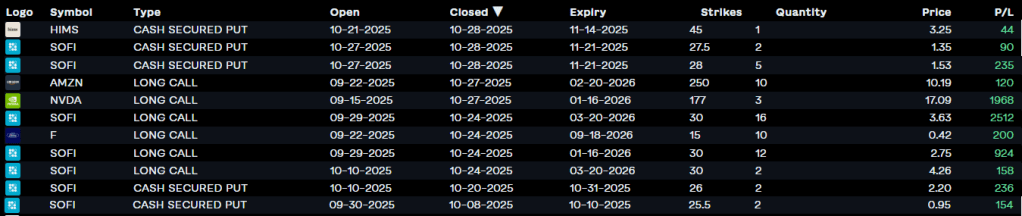

Here are the trades.

Here’s a table of my monthly performance.

I’ll go over how I did it in a minute, but, girl, first I gotta talk about …

Wife Changing Money

Bagholding is an informal, colloquial term in finance that describes the act of holding shares of a stock after its price has dropped significantly, often far below the price at which the investor purchased them.

The Bagholder continues to hold the stock, typically refusing to sell in the hope that the price will eventually recover, even when all fundamental and technical signs indicate the price decline is permanent or long-term.

A failed trade does not have to be a multi-year endeavor and become your entire identity.

For a while now I’ve been kinda obsessed with the aftermath of the GameStop saga and the degenerate traders that are now deep in conspiracy, trying to warp reality in the hopes of a dead company making them filthy rich 5 years after they missed the boat. These guys even stoop to looking for clues in children’s books and it’s hilarious, but I craved something new as I’ve been keeping an eye on their cult for a while now.

Like manna from heaven, my prayers were answered as every morning in October I woke up to fresh posts from new bagholders whining about a little company I like to call Beyond Meat. Because the company’s name is Beyond Meat.

Now, first of all, I was vegetarian for about two years and ate their burgers almost daily. They’re great. However, as a company, they run at a negative net margin, which, is rare and funny. They sell their products for less than it costs them to make, so they lose money with every sale. Also remember when their CFO was arrested for biting a man’s nose during a fight?

So, long story short, Beyond Meat’s stock surges from $0.50 to $8.00 in around a week’s time, which is an absolutely massive climb. Stocks do not normally behave this way, and when they do, it’s often wise to stay away until the dust settles or not touch it at all. What usually happens, though, is that tons of people dump their life savings at the top, just before the stock reverses, and they ride the wave all the way back down. It’s really fun to watch from the sidelines, if you call watching a guy lose his kid’s college fund twice fun.

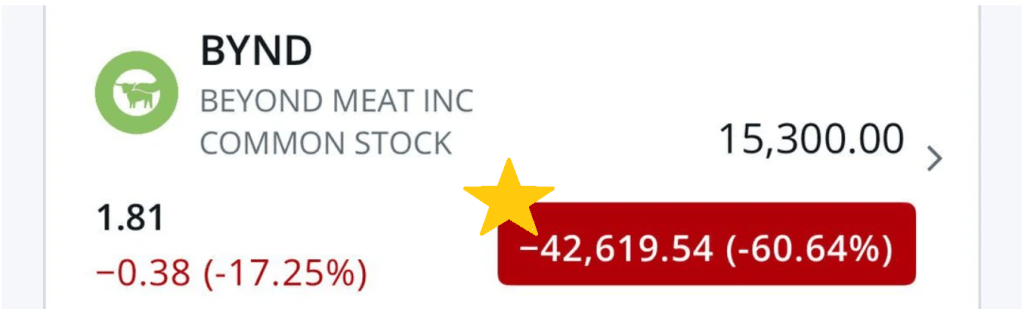

One morning I saw a guy dump $75,000 in as the stock was pumping in the pre-market trading hours, and that’s when I knew the top was in. Sure enough, over the next 2 weeks I watched as he turned $75,000 into $10,000 while the stock went from $8.00 back down to $1.00. Another guy lost over $40k and started savethekoreanguy.com which, I promise, is even zanier than you’re imagining and also has a pretty good video game built in.

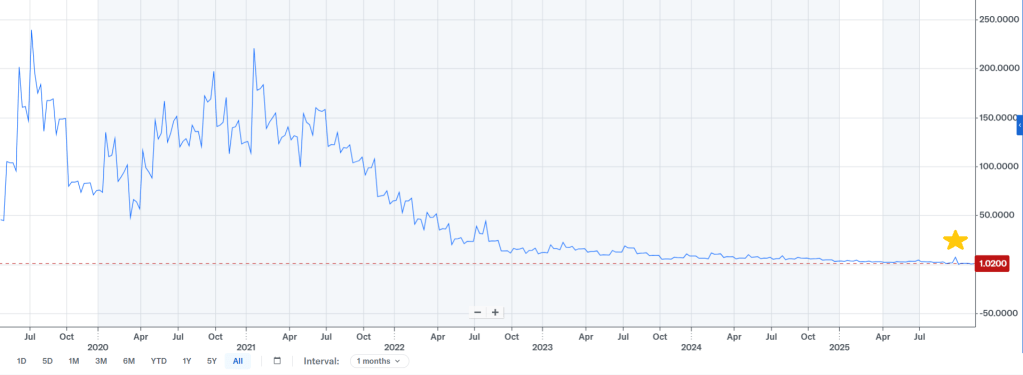

Here’s what the big event looks like from last month on the chart. You can see it jump from $0.50 to $8, before crashing back down to reality. A lot of this hype was led by an AI capybara on Twitter.

Now here’s what it looks like when you zoom out and see the whole life of the stock. I’ve placed a little golden star there to mark the same event that you see in the chart above. That there is when people thought it would be a good idea to HELOC their house and yolo it all into a fake meat company that has never had a profitable year with dreams of obtaining generational wealth.

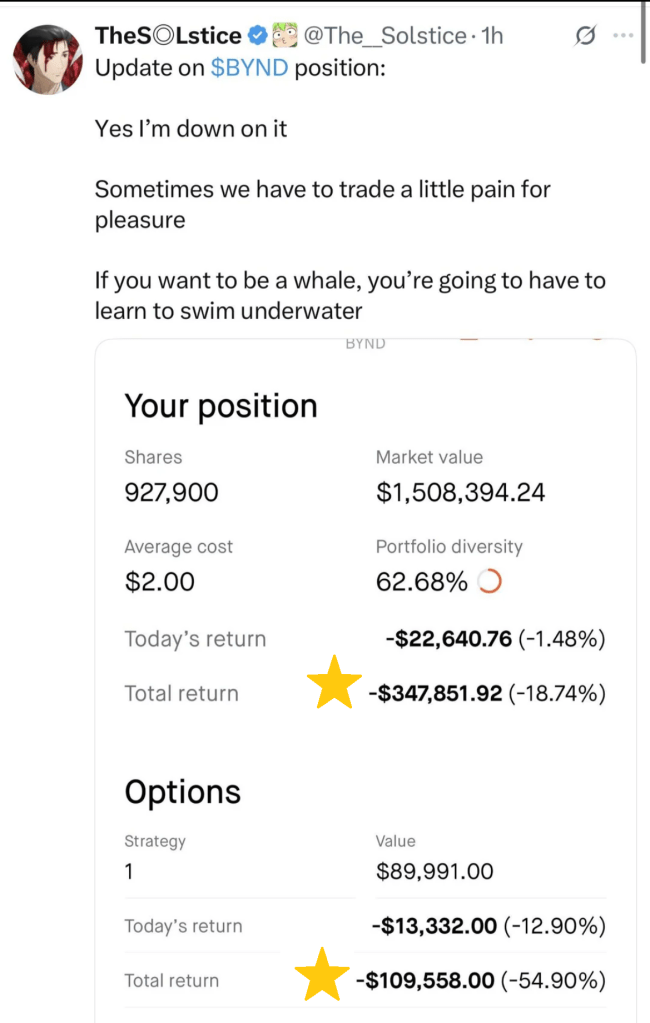

I’ve compiled a small gallery with some of the large losses so you can share in some of my joy.

We’ve been passing down cautionary tales since the dawn of man as a way of entertainment with an attempt to alleviate suffering for future generations. These people went all in on a pump-n-dump and quickly found themselves going from trying to make a quick fortune to becoming a self-soothing community of bagholders with like-minded losers who are unwilling to accept their mistakes, spinning stories to ease their pain, while holding out for hope leading to even heavier losses instead of owning up and moving onto better things.

I can’t help but wonder how people so silly got their hands on so much money to lose in the first place. They’re even going out and buying tons of product in an attempt to boost sales so the stock price goes up lol.

Put checkpoints within yourself to make sure that you are not feeding your own bias. Play devil’s advocate. Search out articles that express the counter-point. I’m gonna be honest, I can be gullible as hell, and I think that’s true for just about everybody. Just because someone is an author, podcaster, or blogger like me with dozens of views, doesn’t mean they’re always right or that they’re right for you.

Do not fall for the allure of getting rich quick by trying to jump in on a meteoric rise of some penny stock. There’s been an influx of these cheap stocks hilariously ruining people’s lives recently so I’m trying to do my part.

I’ve compiled a small list of key words and buzz phrases that should send you packing if you hear them in regards to an investment that you’re interested in. I hope you heed my warning so that you don’t find yourself all-in on a stock that’s already climbed over 1000% in a week (not a joke number) like these baffoons.

Red Flag Terms: short squeeze, short sellers, shill, hedgies, FUD, HODL, DD, ape/apes, tendies, dark pools, diamond/paper hands, or “To The Moon” usually followed by too many rocket and moon emojis.

To wrap it up I’m gonna take a page out of their playbook and end this article on meme stocks the way most of them do, with a quote from Anne Frank.

“How noble and good everyone could be if, every evening before falling asleep, they were to recall to their minds the events of the whole day and consider exactly what has been good and bad. Then without realizing it, you try to improve yourself at the start of each new day.”

-Anne Frank

It’s Quiet… Too Quiet

A large chunk of my profits came from buying and selling 3 Nvidia call options. I bought them for $1,709 each and sold them 43 days later at $2,365 each for a total profit of $1,968. I also bought and sold some call options on SOFI for quite a large profit, too, but buying call options is riskier and something I’ll talk about more in a future post.

“Be fearful when others are greedy, and greedy when others are fearful”

– Warren Buffet

The market was green as all get out this month, which makes me nervous. Things seem a little too optimistic and everything’s just climbing for no reason, especially when most of the nation is in agreement that things are kinda bleak right now. This has caused me to shift back into selling options, as opposed to buying, and I have not used margin for quite some time.

When starting out with options, you’ll see a lot of people advising against trading around a company’s quarterly earnings call. This is often good advice as these events are binary and unpredictable. A company can have an outstanding earnings report and the stock will absolutely tank, and vice-versa.

However, with some experience, I think these events can be played safely as long as it’s a strong stock and the vibe is right. It’s a great environment for selling options because volatility increases, which makes the price of options increase. When you’re selling options, this is what you want.

It goes like this; before the earnings call, all the answers are unknown and this means volatility increases and the option prices follow suit. We don’t know how well the company did the last 3 months, if they beat expectations, or what their forward guidance is.

After the earnings call and all the answers come out, volatility collapses as all the unknowns become known. Things are a little more stable now. This is good news for you when you’re selling options because the value of the contracts you sold have also decreased, and you can now buy them back at a lower price.

As I’ve mentioned before, I’ve mostly traded SOFI this year. I sold a total of 11 Cash Secured Puts in October on SOFI, with 7 of them being sold a day before earnings were released. This means I agree to buy 100 shares per contract if the price was at my strike price by it’s one month expiration date, while getting paid a premium to do so. Check out my brief explanation of options here, if you’re lost, and scroll down to the section called, “Selling Puts”.

I had to set aside enough collateral to buy the shares minus the premium paid to me for selling the contracts.

$19,500 for 700 shares – $1,035 Premium = $18,465 Collateral set aside

You’re paid a premium the second you sell an option and the name of the game is to keep as much of that money as possible. I was paid $1,035 in total and bought them back the next day at a lower price for a profit of $325 for ~30% profit. Not bad for a day’s work.

Hedge Fund? More like Hedge FUN!

One of my buds trusted me enough to send me $1000 of their own money to trade with. The plan is just to trade with that amount and send any profits, minus taxes, back to her.

I’ve only opened two contracts so far, but I’ve already been able to send her back $159 in the first month!

I’ve been trading in my sons account for a while and in December I’ll be trading with a few thousand dollars that also isn’t mine. It’s been interesting to see how differently I behave with someone else’s money. I tend to be aggressive and take larger, calculated risks with my own capital. However, I’m not as comfortable doing that with someone else’s money. When I discuss strategies with them, they’re never thrilled on the more aggressive option, either, and always want to go the safest route, even if that means smaller returns.

This is understandable as it seems most people relate the market to people going broke and that simply comes from inexperience. We’re afraid of what we don’t understand. I hope that a years worth of tracking my progress on here has shown you that doesn’t have to be the case.

Trading is a unique skill and it’s been rewarding to use it to help others. My goal is to show you that you can do it, too, if you keep your wits about you.

Now go get ’em, Tiger,

Chris

If you’d like to give trading on Robinhood a try you can click my referral link HERE and we’ll both get some free stock.

Further Education

I absolutely love this documentary and have watched it several times. It’s actually a two-parter because these idiots move onto dumping all their money into Bed, Bath, and Beyond as it spirals into bankruptcy. It’s lunacy and their stupidity and greed are unmatched.

Leave a comment