I always had a passion for flashin’

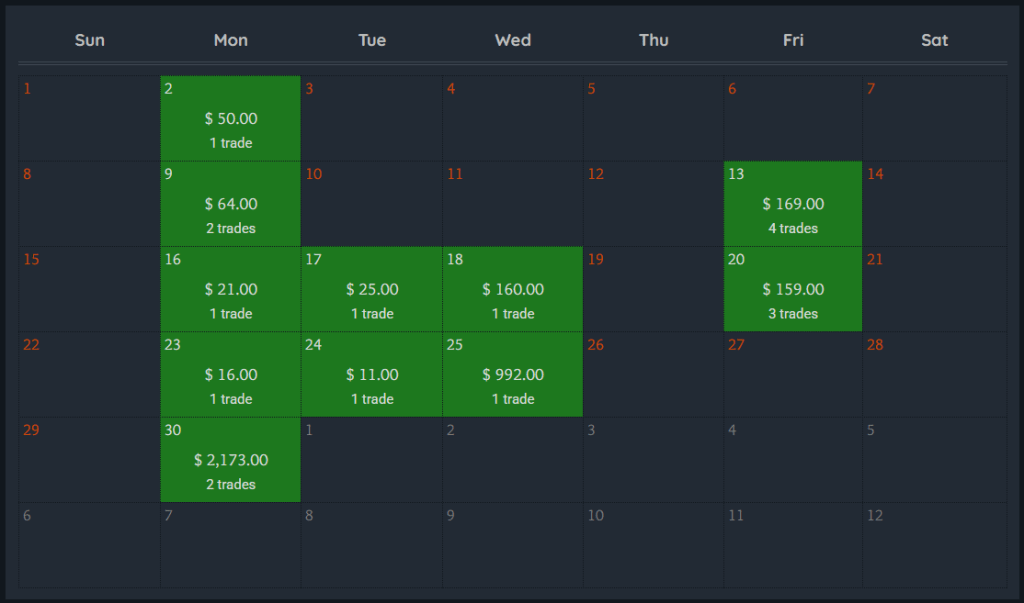

My monthly goal is to increase my accounts by 10%. In June I achieved an increase of 31.86% bringing in $3,840 total.

I’m up 83% this year increasing my accounts by $7,575 so far in the year of our Lord 2025. Even though it’s been on a tear and recently hit an all time high, the S&P 500 has only returned 5.5% in this same timeframe.

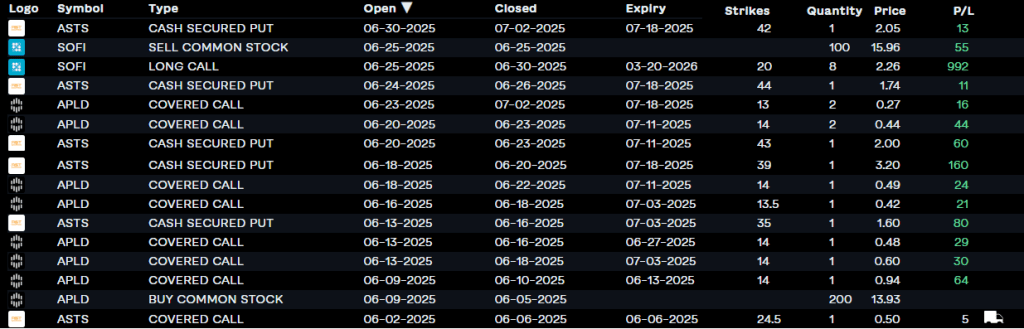

Here are the trades.

Here’s a table of my monthly performance compared to the S&P 500’s.

| Profit | % Change | S&P 500 | |

| Jan | $1,214 | +13.7% | +2.7% |

| Feb | $1,741 | +16.85% | -1.42% |

| March | $339 | +2.8% | +5.75% |

| April | $182 | +1.46% | -0.76% |

| May | $459 | +3.64% | +5.9% |

| June | $3,840 | +38.6% | +5% |

Calls to the Wall

Alright, so how did I make over $3000 this month?

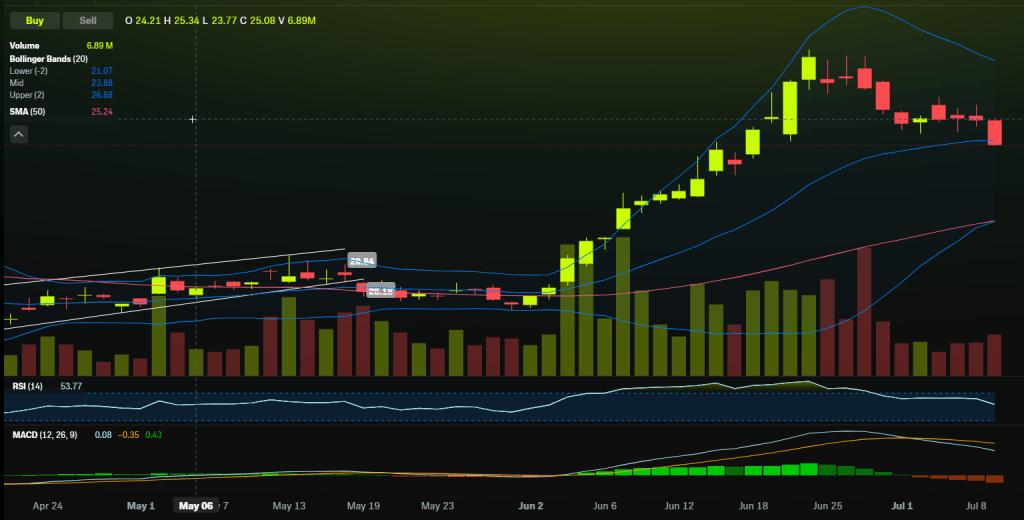

Well it allll began way back in March when I started buying Long Calls (aka LEAPS) on SOFI.

Now if you think a stock is going to go up and you don’t want to buy shares, LEAPS (Long-term Equity AnticiPation Securities) are what you’re looking for. You can think of them as a stock replacement. The game plan is to buy contracts at a low price and sell them at a higher price. Simple enough.

In this situation the difference between buying a LEAP and buying 100 shares was $150 vs $1,500 with SOFI. I’m able to control around the same amount of shares, depending on the contract selected, for a fraction of the cost! That’s leverage, baby!!

In my Roth IRA I purchased 18 of these $150 contracts over the course of the year. I sold them all for $270 each bringing home $2,160!

Once I noticed a lot of momentum I got brave and bought some more LEAPS in my brokerage account. I bought 8 at an average price of $226 and 5 days later I sold them for $350 making another $992 in profit.

Here’s what the position looked like in one of my Robinhood accounts towards the end. You can see I’m holding 18 contracts with an average cost of $1.50. That’s actually $150 because contracts “control” 100 shares, so you must multiply by 100. The value of the contract grew by $1.11 and now the current price is $2.61. That difference is multiplied by how many contracts I own and that’s my profit minus fees.

$261 – $150 = $111

$111 x 18 = $1998

No Free Lunch

The trick is these bad boys have expirations so you must be correct on many factors like volatility and time, not just price movement, to be profitable. That’s why I tend to buy them at least 1 year out to expiration giving me plenty of time to be wrong. And for a while I was wrong as they were down 50% for a minute and there’s always the possibility of losing the total amount of capital that you put in when you buy options. In this case that would’ve been thousands of dollars. These contracts didn’t expire until March, I just chose to take profits now to be safe.

But, admittedly, it wasn’t without a fight. It took the counsel of 2 people close to me to gently remind me that I had a wild look in my eyes and that it didn’t seem like I was following my rules.

Just a few days before, there I was happy and content about the trade being up $200 only to find myself being a greedy little pig wanting even more as I was sitting on $3000 in profits. That’s a dedgum 90% return on my investment and I was still wanting to squeeze out more juice! How ungrateful!

This is just another time when I’m reminded that trading is almost completely a mental game and I must not be swayed by emotions.

Now in full transparency had I stayed in the trade I would have actually made several more thousand dollars at this point and that leaves me with a choice between being grateful for the $3000 I just made or dwelling on what could’ve been. Ultimately I made the right decision by sticking to my rules and I have no regrets. I’ve already started loading up on new contracts that expire 2.5 years from now.

I mostly sell options so that I’m paid to open contracts. Buying them is much more risky and, you know, costs money so I prefer selling Cash Secured Puts on stocks I wouldn’t mind owning and selling Covered Calls on stocks I own at a price I’m willing to sell at. But done correctly LEAPS can be very powerful and will be something I utilize more from now on.

Alright… but fool me THREE times…

Some good news followed by a picture with Jeff Bezos and the CEO of AST SpaceMobile being posted caused a stir and made all my precious shares get ripped out of my arms again. This is the second time this has happened to my favorite stock.

I had to sell them at $24 while the stock shot to $50. That’s around $3000 of opportunity loss because I was Selling Calls in low volatility environment on a stock I didn’t particularly want to get rid of at that price. Funny how obvious things are in hindsight when you say them out loud.

I turned around and sold 4 Cash Secured Puts on ASTS in total making $324. I changed my strategy on this as I was selling puts while the stock price was rising this time around. I normally sell puts when the price is going down because I’m paid more premium to do so. Selling puts while the stock price goes up puts the odds in my favor even more with the trade off being less premium being paid to me.

But if I sell puts on a stock that is ripping upwards my chances of winning are greatly increased, the only downside is I’m paid less premium. And because I was so very correct these trades were only open for 2-3 days each allowing me to rinse and repeat.

Honestly, this was a very trying time for me. Seeing my favorite stock get called away again while it rockets off truly hurts. Psychology says FOMO is more painful than loss.

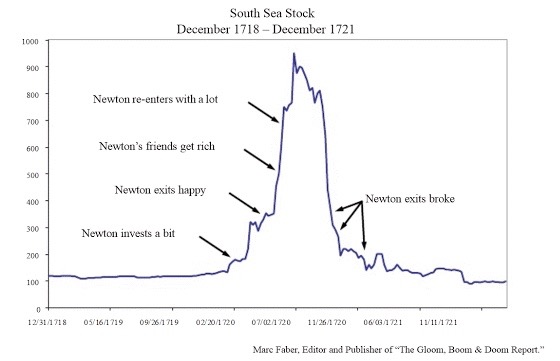

Ultimately I have paused on Selling Puts on ASTS because it’s in a downtrend and I’m not trying to catch a falling knife. This stock has mooned then gradually slid back down to where it was before. I just have to be patient and hope it does the same this time. I’ve made this mistake in the past and see people wiser than I do it all the time…

… People like Sir Isaac Newton! A couple of months ago I quoted him as saying,

“I can calculate the motion of heavenly bodies, but not the madness of men.”

– Sir Isaac Newton, sore loser.

The quote is a reminder of the importance of understanding human psychology in speculating financial matters and he said it after he lost a fortune in the South Sea Bubble. Long story short, Newton makes a lot of money, lets FOMO get the best of him, then loses everything.

Its helping me hold a strong resolve as I fight the temptation of getting back into a stock that I think is priced too high, especially for a pre-revenue company, along with a price movement that was unwarranted by the news. I know nothing but my gut is telling me to wait and let the dust settle.

If I sell a Cash Secured Put with a strike price of $44 and the stock continues to drop back to the $22 range, that misjudgment just cost me $2,200 in unrealized losses and a lot of frustration. I’m attempting to avoid that and wait for confirmation that the stock is trending back up. It’s this new thing I’m trying that doesn’t involve gazing into a crystal ball.

Feel free to shoot any questions or comments my way.

Live

Laugh

Leverage

Chris

Oh, we also went on a week’s vacation to D.C. this month. Here’s video proof.

If you’d like to give trading on Robinhood a try you can click my referral link HERE and we’ll both get some free stock.

Leave a comment