OOOO WEEEEEEEEE!!!

Last month I was able to close out my Nvidia position and this month my 100 shares of Robinhood were finally called away freeing up around $7,100 so I’m back in the saddle, babyyy.

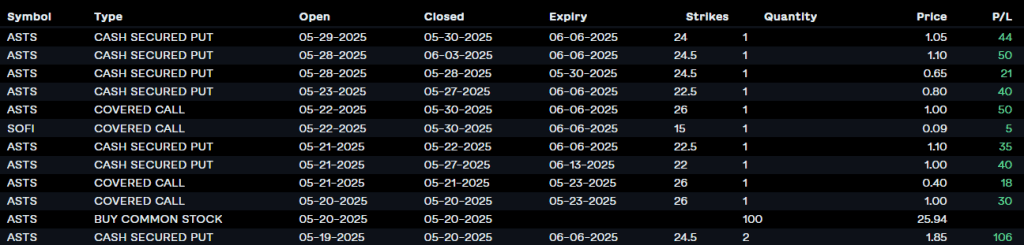

I got right back to it and starting selling Cash Secured Puts on AST Space Mobile (ASTS). I sold 7 in total bringing in most of this month’s profits.

On the flip side I did a Buy/Write on the same stock. I bought 100 shares at $25.94 and started selling Covered Calls against them. 3 in total with 2 of them closed out on the same day. Those brought in $98 in one week dropping my average share costs down a dollar to $24.96 in just 3 trades! One of the many advantages of Covered Calls.

To quickly summarize I sold 7 contracts agreeing to buy 100 shares if the price fell to a certain point. It never did and I got to keep the premium paid to me for selling them. I also bought 100 shares of the same stock at market price and wrote 3 contracts agreeing to sell them if the price rose to a certain point. Which it did on the final one and they were called away.

I explain these strategies here if you’d like a primer.

Rodeo Roundup

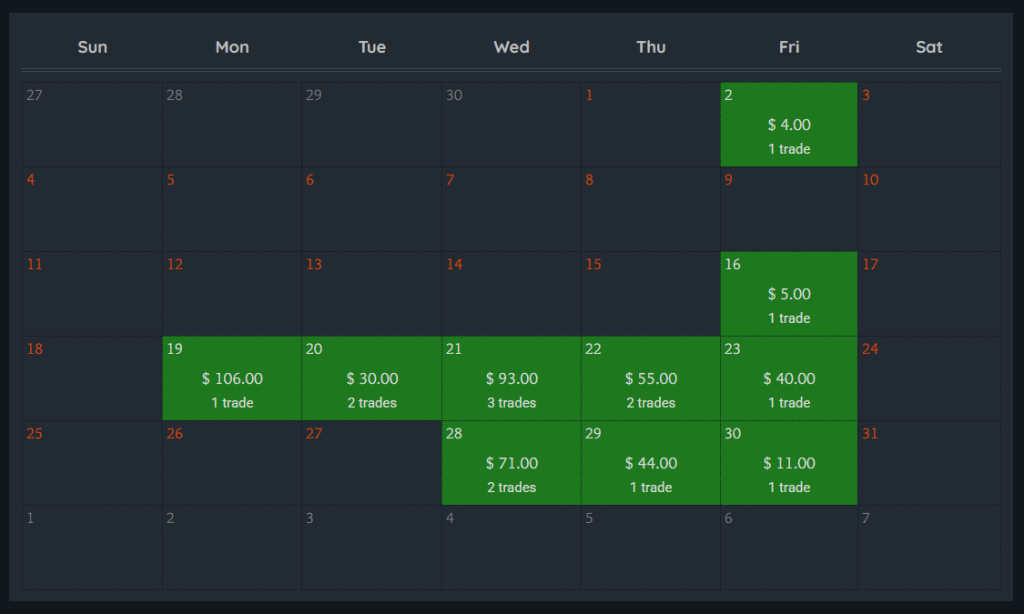

My monthly goal is to increase my accounts by 10%. In May I achieved an increase of 3.64% bringing in $459 total with 15 trades and no losses.

I’m up 43% this year increasing my accounts by $3,935 so far in the year of our Lord 2025. The S&P 500 has only returned 0.5% in this same time.

Here are the trades.

Here’s a table of my monthly performance compared to the S&P 500’s.

| Profit | % Change | S&P 500 | |

| Jan | $1,214 | +13.7% | +2.7% |

| Feb | $1,741 | +16.85% | -1.42% |

| March | $339 | +2.8% | +5.75% |

| April | $182 | +1.46% | -0.76% |

| May | $459 | +3.64% | +5.9% |

Now it’s time for Chris to relate trading to everyday life.

I’ve been gardening for a little over 3 years and after many disastrous attempts in the past I can safely say that things have clicked. It’s even what I do for work now! As I gained more experience I started taking note of things that I would do differently in my garden if I got the chance to start over.

Well my time has come because my lady and I just bought our first home together! It has a large yard and I’m doing things bigger and better this time. I even called before I dug!

My life seems to flow between different themes. This month my yard and stock portfolio are blank canvases and I’m getting to approach both with a little more experience. We’re creatures of habit and trading can be an emotional game so I will freely admit that I have still made some of the old mistakes this month when it comes to patience and FOMO, but I was able to recognize my behavior and change course a little quicker than in times past. I’m improving, it’s calculatable, and that’s all I could ask for.

It takes going through many seasons to see all the different ways things can play out and take shape, not to mention you and your tastes evolving as well. You see what you like, how to manage what you have, what’s not worth the hassle, and learn from your mishaps.

Look, I could sit here and come up with gardening metaphors till the cows come home. I get excited and want to get to the finish line but gardening and investing don’t really have finish lines. I have to remind myself of that and slow down. I have a big yard with lots of room for growth just as I have lots of time to grow my wealth. In both I’ve got to do the tough thing sometimes, then remember to sit back, enjoy it, and be grateful, as well. Finding balance in life is crucial.

Some photos of the old garden.

One of my main jobs is assisting people with plants and the most common beginner mistakes comes from fiddlin’ with them too much. Too much water, moving ’em all around, and just generally worrying too much. They can smell the fear on you.

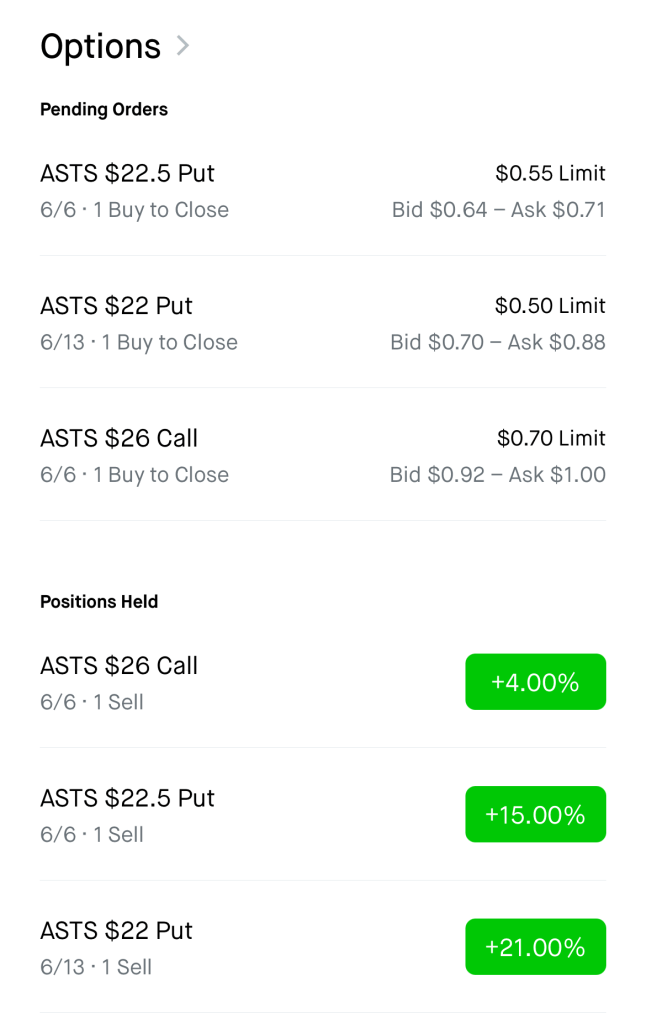

But by selling my contracts only one week out instead of several I’m doing the same exact same thing in my own, adorable, way. I’m just doing too much fiddlin’ and taking too much risk. Now I already have things set up to auto-trigger at my price targets so it’s not as if I’m staring at charts all day. I sell a contract then immediately set an order to close that contract once it hits my profit target. Most of the time I’m buying back the contract at 50% profit so I can take risk off the table and move on to the next trade. Below is a look at my order screen using Robinhood.

Up top under “Pending Orders” is where I’m set to automatically close out of the positions (below) once it reaches 50% profit.

Under “Positions Held” at the bottom you can see my open orders along with how much profit I’ve made since opening it in the green.

Some of these previous failed gardening attempts were quite large. Fenced in raised beds with chickens, 250 gallon aquaponics tanks, and enough houseplant blood on my hands that I’ll never be let through those pearly garden gates.

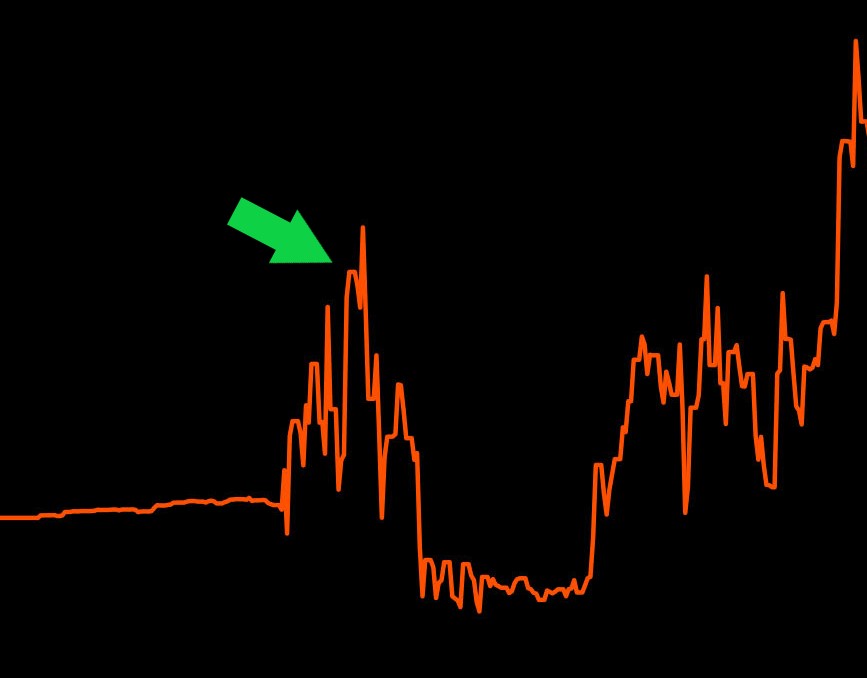

I tend to go all-in on things and figure it out as I go. Below is a chart with an arrow showing the exact moment I discovered trading options and the subsequent abyss I slogged through in the wake of that pivotal moment.

I’ve never looked at the past and thought I had things more figured out than I do now. I’m meant to evolve just like every thing else. So I try to keep in mind that currently, even right this very second, there is something I’m wrong about and something I will change my mind on in the near future.

And, boy, it’s easy to be wrong in the stock market. Thankfully, selling options has less risk so when I’m wrong it’s usually only costing me time and frustration.

I’m writing this from the future and let me tell ya I would definitely do things differently this month. The last Covered Call I sold on my 100 shares of ASTS ending up getting called away at $24.50 a share while the price mooned to about $40 a share. That’s almost $2000 I missed out on so it looks like I’ll be changing some things up.

Seeing what I was able to do in such a short time has me hopeful for next month. It at least makes Mondays exciting.

Ya’ll come back now,

Chris

If you’d like to give trading on Robinhood a try you can click my referral link HERE and we’ll both get some free stock.

Leave a comment