Before we get started on my inaugural review be sure to check out this page if you need a simple primer on the different strategies discussed here.

Recently the market has been uneasy about the car wash of stupidity we’re about to drive through. Now that’s just a cheeky way for me to say the market has not been doing so hot lately, but when you are on the side of selling options you can make money when things trade up, down, and sideways.

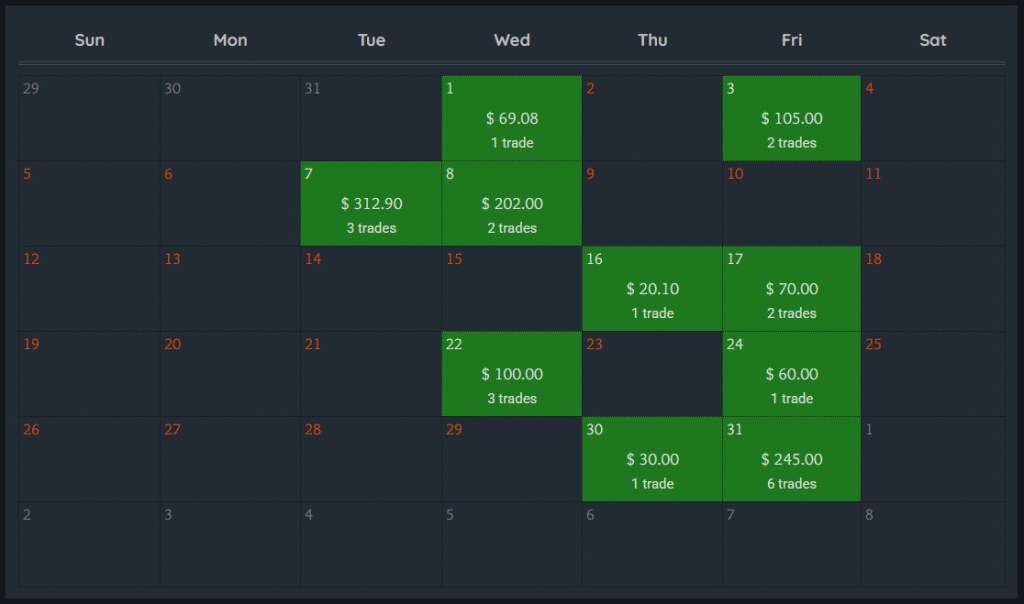

My monthly goal is to increase my accounts by 10%. In January I achieved 13.27% with around 2/3 of those profits coming from trading options and the other 1/3 from trading stocks.

22 total trades with no losses and increasing the accounts by $1,214.

Here’s the play I’m most proud of this month and I’ll break every thing down but first let me just say I owe a lot to the inspiration I get from others in all areas of my life. I find myself constantly inspired by someone’s tenacity and dedication towards their passions. I had been peeping what other positions people were taking in the market when I stumbled upon a series of trades one person was able to pull off so smoothly that I had to give it a whirl.

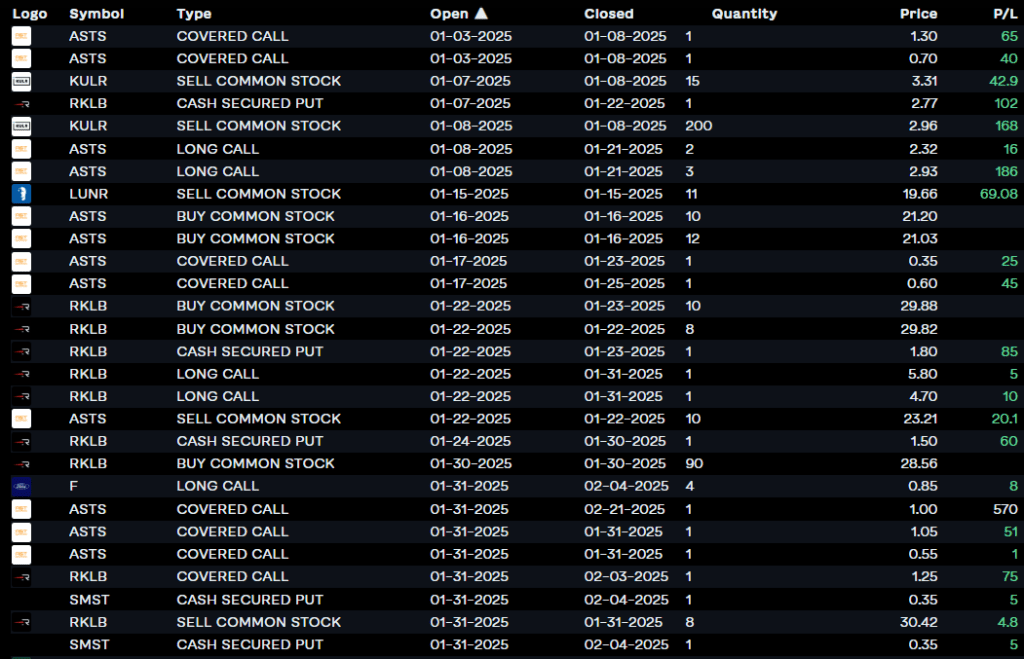

Over the course of a few days I would simply pull up their handful of trades, like the ones listed below, and admire them which would lead me to work out how I could replicate it in my trading. Here is what I pulled off.

Listed first you’ll see I sold 3 consecutive Cash Secured Puts in hopes that the stock price would drop and I would be assigned 100 shares. Although the price rose and I wasn’t assigned the shares I was paid a total of $247 in premium for taking on the obligation. That’s money earned without actually owning any stock!

After that I decided to perform a Buy/Write where I purchased 100 shares then sold a Covered Call against them. In total I opened 3 Covered Calls agreeing that I would sell my 100 shares if it rose to a certain price by a certain time. It didn’t and in total I was paid $151 in premium while getting to keep my shares. That’s extra money earned just for owning stock!

After this I sold all 100 shares at a $30 profit because my sentiment had changed and I wanted to lock in my profits. I made $428 in total when it was all said and done.

Easy-peasy.

The beauty is any of the above strategies can work alone or you can make them dance together. You can just buy and sell stock. You can just focus on cash secured puts. You can put all your energy into finding proven, blue-chip companies with a strong dividend and writing covered calls against shares that you own using the premium collected to buy even more shares. It’s why they’re called options.

Lastly I’ll leave you with the full list of my trades for the month.

Handstanding on the shoulders of giants

I wouldn’t know most things were possible unless someone did them first and was willing to share that knowledge and experience. Take Roger Bannister beating the 4 minute mile, for example. For decades all thought this was impossible but once the record was broken by one person suddenly thousands were able to follow suit around the world. So I keep a look out for my own Roger Bannisters.

I work best by building on the work of others, not coming up with completely new discoveries. I’m OK with that. I like getting fired up by other people’s achievements. I’ll take that over the alternative.

So get on out there and find your own inspiration in whatever it is that you’re up to. Stare at it. Ponder it. Let it marinate in your subconscious. Show it to your co-workers who don’t care.

Leave a comment